Dasin Retail Trust: Grounding on Healthy Operating Metrics

traderhub8

Publish date: Wed, 15 Aug 2018, 02:12 PM

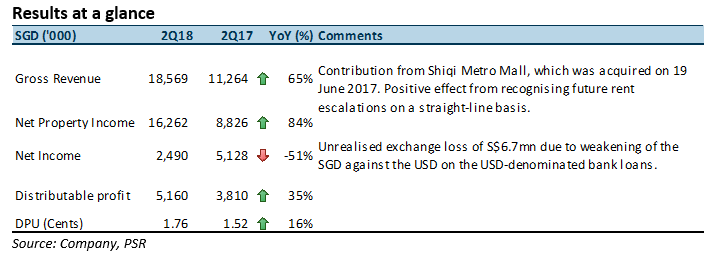

- Revenue in line with and NPI exceeded our expectations for 2Q18. Boost in revenue from the acquisition of Shiqi Metro Mall in June 2017. Organic growth was 10.4% YoY.

- Strong 100% occupancy and well-spread WALE (by GRI) of 4.07 years.

- Increase in gearing due to revaluation of investment properties.

The Positives

+ 10% of leases by GRI were renewed in 1H18, with 12.2% positive reversions and 100% portfolio occupancy. What this tells us is that there is demand for the space, and it is currently under-rented. The WALE has also been lengthened QoQ from 4.01 years to 4.07 years. While the 17.9% of leases (by GRI) that are due for renewal in 2H18 poses some concern, the Manager has proven its ability to execute. As such, we expect positive rental reversions to maintain in 2H18.

The Negatives

– Gearing increased to 31.5% in 2Q18 from 30.4% as at end 1Q18. This was mainly due to the decline in valuation of investment properties, which relates to the lease renewals of anchor tenants at Xiaolan Metro Mall and Shiqi Metro Mall, where the newer rents were lower than those of smaller, non-anchor tenants.

Outlook

Current gearing of 31.5% affords Dasin S$138.6mn of headroom (assuming 40% gearing) to pursue inorganic growth, which will be through its ready pipeline of 20 properties – 12 of which have been completed.

Downgrade to ACCUMULATE with unchanged target price of S$0.97

Fundamentals remain intact, and our target price remains unchanged. Our rating downgrade is purely due to the recent positive price moment.

Source: Phillip Capital Research - 15 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024