Land Transport Sector: Taxi Turnaround in Sight

traderhub8

Publish date: Mon, 30 Jul 2018, 10:27 AM

- Maintain Overweight on the Land Transport sector, on the positive industry restructuring and the worst being over for the Taxi industry

- Maintain Accumulate on ComfortDelGro; unchanged target price of $2.69

What is the news?

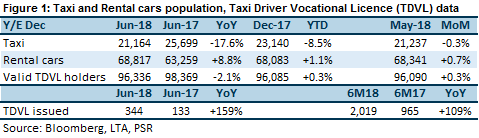

Land Transport Authority (LTA) has published motor vehicle population and Taxi Driver Vocational Licence (TDVL) data for June 2018.

- New entrant Tada has launched its ride-hailing app that uses blockchain to keep a record of rides. The platform has 2,000 drivers and does not charge them a commission. Tada does not feature dynamic pricing, but imposes a surcharge during peak periods. Tada joins Filo Technologies, Ryde, Kardi, Jugnoo and incumbent Grab in the ride-hailing space. Go-Jek has expressed its intention to launch in Singapore too.

- ComfortDelGro Corp will be buying up to 1,200 petrol-electric Hyundai Ioniq hybrid taxis. The taxis will be delivered by the middle of 2019. This is in addition to the 200 hybrid taxis that were already purchased in May this year, and the subsequent tender for 500 more.

How do we view this?

The Positives

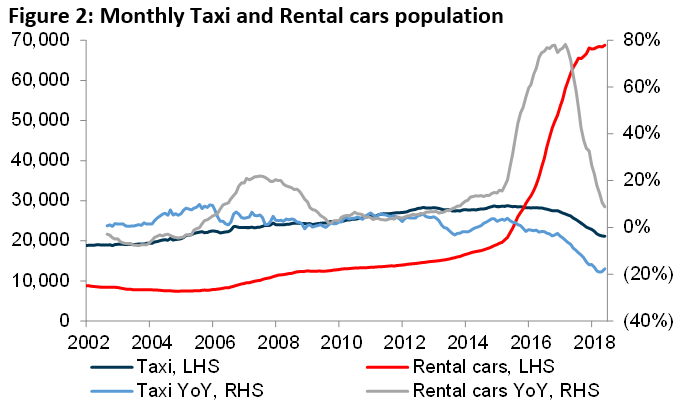

+ Rate of decline in Taxi population shows sign of bottoming. YoY contraction had peaked in April 2018 at -19%, and the pace of contraction has slowed down for two consecutive months. We believe the worst is over for the Taxi industry, in view of the positive impact following the exit of Uber and resultant restructuring of the ride-hailing industry. ComfortDelGro has also started buying new taxis.

+ Rental cars YoY growth continues to taper down, reaching single-digit growth rate for the first-time in four years and seven months. The last time there was single-digit growth was in November 2013, and the growth rate had remained double-digit ever since.

+ Momentum for TDVL issued has been maintained. Each of the six months YTD saw at least +22% YoY growth in TDVL issued. The total number of TDVL issued for 6M18 period has doubled YoY, and has been sufficient to offset the natural attrition of licence expiries. The number of valid TDVL holders remains flat at +0.3% YTD. We maintain our view that a sustained average of about 400 new TDVLs issued monthly would be sufficient to result in growth in number of valid TDVL holders.

The Negatives

– +0.7% MoM growth in Rental cars population. This comes as a surprise, as we were expecting a MoM decline instead. Our expectation was based upon earlier media reports of unhired cars from Lion City Rentals (LCR) being put up for sale in the used-car market, and only 51% of private hire chauffeurs had passed the Private Hire Car Driver’s Vocational Licence (PDVL) by the June 30 deadline.

Note: ComfortDelGro Corp will be releasing 2Q FY18 financial results after market hours on Aug. 10.

Investment Action

We maintain Overweight on the Land Transport sector, on the positive industry restructuring following the exit of Uber and the worst being over for the Taxi industry. We maintain our Accumulate rating on ComfortDelGro, with unchanged target price of $2.69.

Our previous Land Transport sector report was published on 9 July

- Taxi population continues to contract, but YoY contraction shows sign of bottoming

- Rental cars YoY growth continues to taper down, reaching single-digit growth rate

Source: Phillip Capital Research - 30 Jul 2018

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024