Frasers Centrepoint Trust: Steady as She Goes

traderhub8

Publish date: Fri, 27 Jul 2018, 10:29 AM

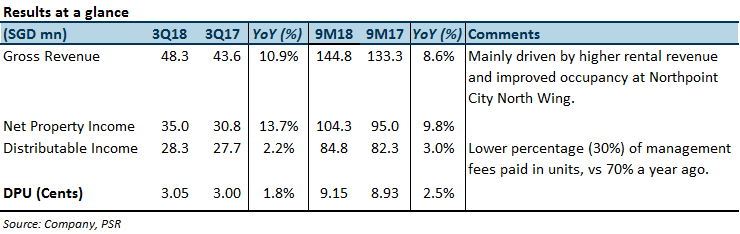

- 9MYTD NPI and DPU were in line with our forecast, at 75% of our FY18e forecast.

- Northpoint City North Wing (NPNW) main growth driver for portfolio occupancy and positive portfolio rental reversion.

- Percentage of debt hedged on fixed rates increased to 64% with all-in cost of debt maintained at c.2.5%.

- Maintain Neutral with higher TP of S$2.15 (prev. S$2.14).

The Positives

+ Overall portfolio occupancy stable at 94% as NPNW continues to fill up post-AEI. Occupancy at NPNW currently at 95.2%, compared to pre-AEI level of 65.9% a year ago, and is expected to improve to 97% by the end of FY18 after factoring in pre-committed leases. Changi City Point had also seen improved occupancy, from 90.6% to 92.6% QoQ.

+ Overall rental reversion maintained at 5% driven largely by NPNW. Portfolio rental reversion of 5% on par with FY17 rental reversions. A tenant within the financial institution sector had taken over a large lease next to its existing space, which was initially due for renewal during the quarter. The renewed lease accounted for c.50% of NPNW’s renewed NLA and was the main driver for the mall’s +25.8% rental reversion in 3Q18.

+ Increased percentage of debt hedged while keeping all-in cost of debt in check. Subsequent to the quarter, FCT had increased its proportion of debt on fixed interest rates to 64% (30 Jun 2018: 55%) while keeping all-in cost of debt largely in check, at 2.5%.

The Negatives

– Tenant sales was lower YoY overall in the single-digit percentage range, excluding NPNW and CCP. NPNW and CCP lifted portfolio tenant sales to 3.4% YoY. There has not been any YoY improvement in tenant sales at the other malls for two quarters. Portfolio occupancy cost has crept up to 16.3% from 15.3% in FY15, in part due to NPNW’s AEI. We opine that tenant sales would need to catch up fast enough to ensure sustainable rental growth.

Outlook

FCT will deploy S$15mn to develop an underpass linking Causeway Point to the upcoming Woods Square. Works will last from end-February 2019 to December 2019 and space carved out for this walkway will be retained under FCT’s reserve GFA bank for future expansion. While there will be a temporary dip in occupancy during this period, the underpass will bring about improved connectivity and expand the catchment area for Causeway Point (48% of portfolio NPI).

Maintain NEUTRAL with higher TP of S$2.15 (prev S$2.14)

Our target price translates to a FY18e yield of 5.4% and a P/NAV of 1.11. There have been adjustments on assumptions on rental reversion rates and financing costs, following a change in analyst.

Source: Phillip Capital Research - 27 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024