Mapletree Industrial Trust: Ramping-up in Hi-Tech

traderhub8

Publish date: Wed, 25 Jul 2018, 04:56 PM

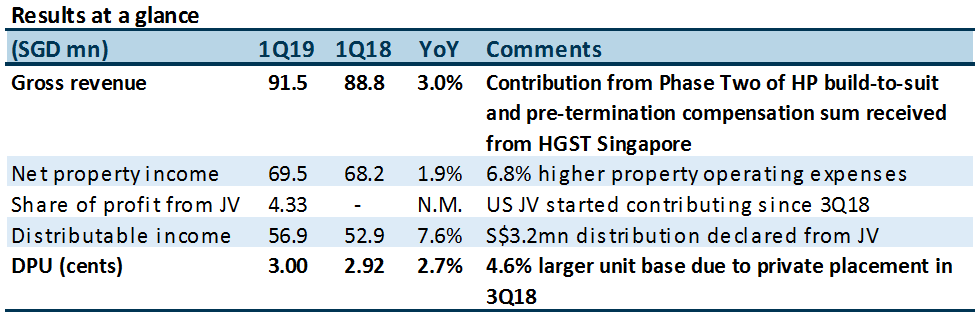

- Gross revenue and DPU were within expectations, meeting 25.6% and 24.8% respectively of our FY19 full year estimate

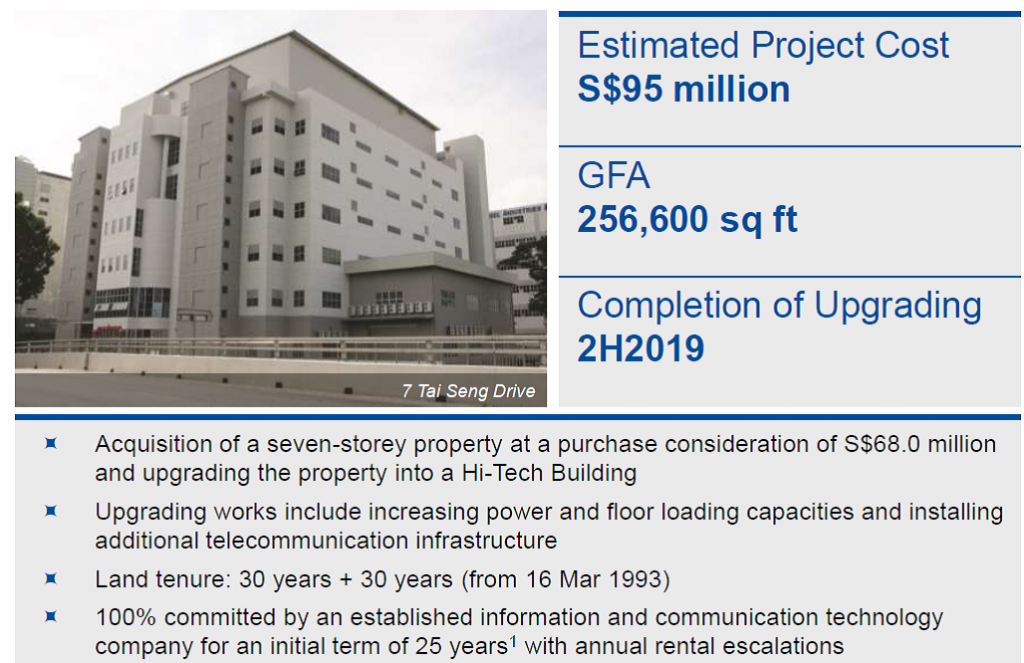

- Acquired 7 Tai Seng Drive on June 27; to be upgraded to Hi-Tech Building

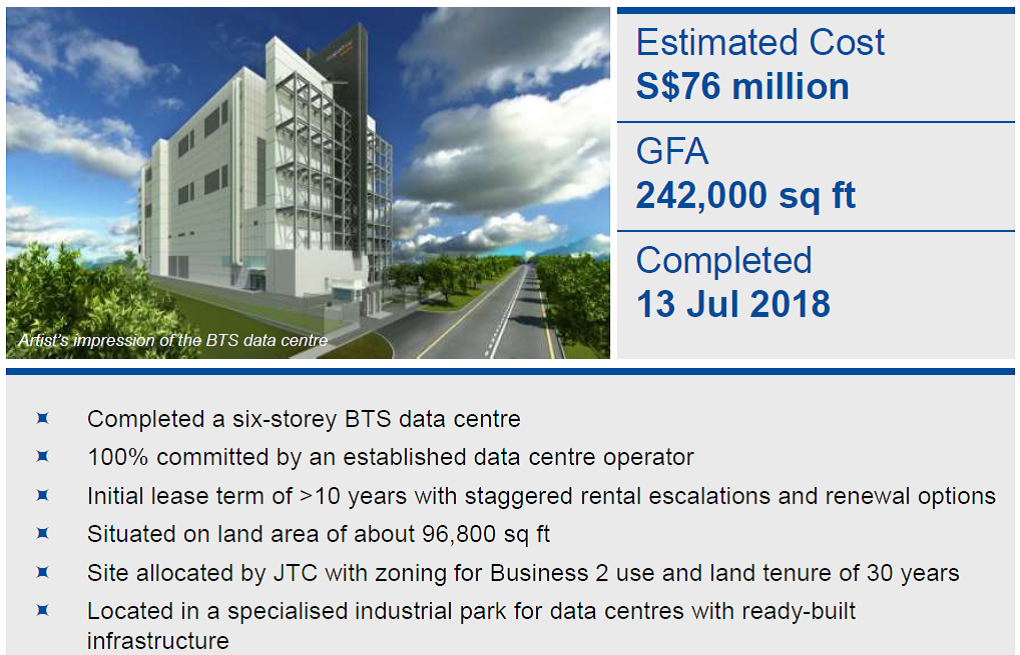

- Build-to-suit data centre at 12 Sunview Drive obtained its TOP on July 13, renamed to Mapletree Sunview 1

- Maintain Neutral; unchanged target price of $2.09

Source: Company, PSR

The Positives

+ 35.0% gearing remains relatively low, compared to the Industrial REITs sub-sector average of 37.4% as at March 31. We estimate a debt headroom of ~S$410mn, potentially growing the AUM by ~10%. However, QoQ borrowing cost has crept up from 2.9% to 3.0%.

+ 30A Kallang Place achieved 43.8% committed occupancy; higher than the 40% in the previous quarter. As a reminder, the asset enhancement initiative was recently completed and the property obtained its Temporary Occupation Permit (TOP) in February 2018. The Manager is in close discussion with potential tenants to secure another 20% commitment.

The Negatives

– Lower occupancy across all segments except Business Park Buildings, resulting in QoQ lower portfolio occupancy from 90.0% to 88.3%. Business Park Buildings QoQ occupancy was marginally higher from 79.0% to 79.1%, due to one new lease signed. Full quarter effect from 30A Kallang Place being included into the portfolio after obtaining its TOP contributed to lower occupancy for Hi-Tech Buildings.

– Portfolio weighted average negative rental reversion of -3.7%. This was led by Flatted Factories (-5.2%) and Business Park Buildings (-3.0%). Negative reversions for Flatted Factories and Business Park Buildings was across the portfolio and not due to specific locations, as the manager lowered rates to maintain competitiveness. Back-filling of space at The Strategy at International Business Park that was pre-terminated by Johnson & Johnson remains unchanged from two quarters ago at 23%.

Outlook

The outlook is stable. At the industrial sector level, there are headwinds from vacancies and negative reversions. However, contribution from inorganic sources such as the US data centres JV, 30A Kallang Place and Mapletree Sunview 1 are adequate to offset organic weakness for FY19.

Maintain Neutral; unchanged target price of $2.09

We fine-tune our assumptions for the contribution from 30A Kallang Way, Mapletree Sunview 1 and include contribution from 7 Tai Seng Drive. Our FY19e/FY20e revenue is now 2.0%/2.9% higher than previous, and DPU is now 0.2%/1.2% higher than previous. Our target price represents an implied 1.42 times FY19e P/NAV multiple.

Figure 1: BTS Project – Mapletree Sunview 1

Source: Company 1Q FY18/19 Financial Results Presentation, 24 July 2018

- The Manager expects revenue to come in by September; there is no rent-free period for this lease.

Figure 2: Acquisition and Upgrading – 7 Tai Seng Drive

Source: Company 1Q FY18/19 Financial Results Presentation, 24 July 2018

- Property to be upgraded from warehouse to data centre

- Existing occupancy of 30% as a warehouse

- The Manager expects a yield of between 6% and 7% after conversion

- Comparable transaction within the Tai Seng area have been at $328 psf, while this acquisition was lower at $265 psf

- The area has become unsuitable for warehousing and buildings in the area have been converted to higher-specifications

- The apparently higher valuation (compared to S$31.8mn from Mapletree Logistics Trust) that MINT is paying for came about as the other bidders were bidding on the site with the intention of upgrading the property

Source: Phillip Capital Research - 25 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024