CapitaLand Mall Trust: Baby Steps Towards a Recovery

traderhub8

Publish date: Mon, 23 Jul 2018, 10:23 AM

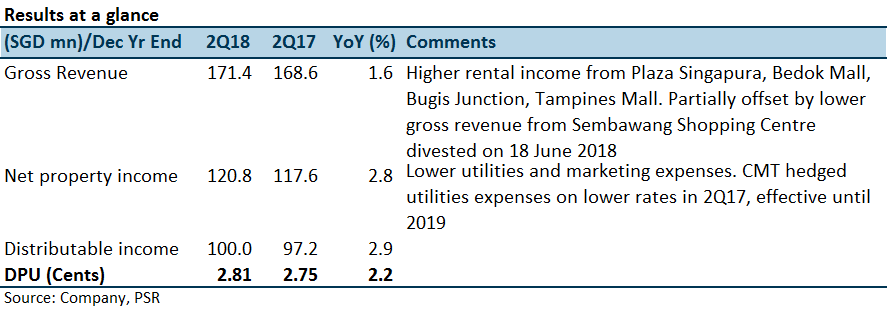

- 2Q18 NPI/DPU within our estimates. 1H18 NPI/DPU at 50% and 49% of our FY18e estimates.

- 10-15bps valuation capitalisation rate compression despite rising interest rates.

- More tenant sectors seeing sales turnaround in 2Q18.

- Overall tenant sales still slow to recover, down 0.2% YoY in 1H18, dragged by slower F&B sales, the biggest tenant sector within the portfolio.

- Maintain Neutral with unchanged TP of S$2.05.

The Positives

- 10-15bps capitalisation rate compression despite rising interest rates. Overall portfolio valuation grew 0.7% or S$73.1mn as a result of compressions in valuation cap rates based on investor sentiment and market transactions. This is notwithstanding “minor downward adjustments” in assumed rental growth rates. This translates to an NAV increase of c.2c/share.

- More tenant sectors seeing sales turnaround in 2Q18. Compared with 1Q18 where 8 out of 14 tenant trade sectors reported lower YoY sales, only 5 sectors reported negative YoY sales growth by 1H18. The three sectors which saw a turnaround in sales in 2Q18 were Beauty and Health, Gift and Souvenirs, and Supermarket, in descending magnitude of improvement.

The Negatives

- Overall tenant sales still slow to recover, down 0.2% YoY in 1H18, dragged by slower F&B sales. This is unchanged from 1Q18, which was down marginally YoY by the same magnitude. We note that F&B, the biggest tenant sector which contributes close to one-third of the Group’s rental income, continue to see lower YoY sales productivity at -0.6%. We think the proliferation of F&B offerings at malls could be a reason for the weakness. For context, F&B contributed 23% of total rental income for CMT ten years ago vs 31% in FY17. The increasing popularity of food delivery services which increase diners’ options to offerings outside shopping malls could also be another cause.

Outlook

Rental reversions have stabilised at 0.8% for the first two quarters, but we opine tenant sales, which has been the crucial missing ingredient in the recovery so far, needs to catch up for more meaningful upsides in rental growth. We are of the view that retail remains the REIT subsector most challenged by advancements in technology including the e-commerce threat. Nonetheless, catalysts for growth remain the upcoming completion of Funan in 2H19 (Pre-leased: Retail: 50%, Office: 20%) or possibly earlier. Management remains confident of achieving its targeted 6.5% ROI on development capex for the project.

Maintain NEUTRAL with unchanged target price of S$2.05. This translates to an FY18e yield of 5.6% and P/NAV of 1.03.

Source: Phillip Capital Research - 23 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024