CapitaLand Commercial Trust: Continued Recovery in Office Rents

traderhub8

Publish date: Fri, 20 Jul 2018, 12:31 PM

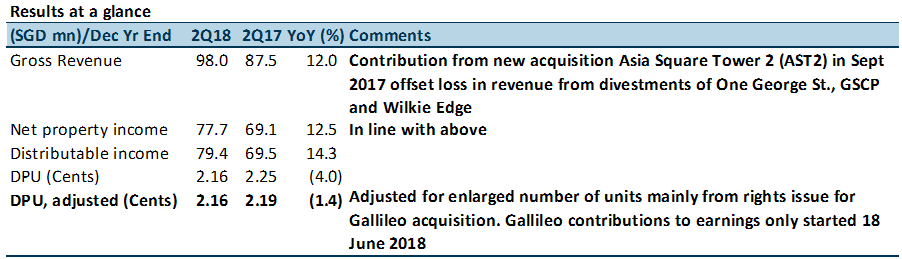

- 1H18 revenue and DPU at 49% of our FY18e expectations.

- Office rents continue to stage strong recovery, growing 4.1% QoQ in 2Q18.

- Increase in portfolio valuation due to capitalisation and discount rate compression.

- Expect negative rental reversion trend to turnaround in 2019.

- Maintain Accumulate with unchanged TP of S$1.88.

The Positives

+ Office rents continue to stage strong recovery. Grade A office rents, as measured by CBRE continue to recover since bottoming in 2Q17. Rents grew 4.1% QoQ in 2Q18, and are up 7.4% YTD. We maintain our expectations for a 5-10% overall growth in office rents for 2018.

+ Increase in portfolio valuation due to capitalisation and discount rate compression. Across the board, these rates were compressed 10-25bps vs 6 months ago. Overall Singapore portfolio valuation grew 1.3% or S$134mn (translating to 3.6c increase in NAV) from end FY17. Management noted the appraisers’ adjustments came after taking into account strong investment sentiment and recent bullish physical office transactions.

+ Expect negative rental reversion trend to turnaround in 2019. While the portfolio could still face headwinds of negative rental reversions over the next two quarters for projects such as Asia Square Tower 2, remaining leases due for renewal in 2H18 account for only c1.5% of total portfolio revenue. We expect overall rental reversions to turn positive in 2019 and gradually improve till 2020, partially due to lower expiring rents over the next two years. Average rents expiring in 2019 and 2020 are c.6.7% higher and 5.5% lower respectively vs current average Grade A office rents.

The Negatives

– Slow ramp up in occupancy for Asia Square Tower 2 (AST2). AST2’s occupancy improved to 91.9% as at 2Q18, from 88.7% when CCT acquired it in 3Q17. Nonetheless, management commented that negotiations are in advanced stages for the remaining one full floor left vacant. Assuming occupancy at AST2 can be increased to full from current level, we estimate this could add an extra 1-2% to annualised FY18 net property income.

Outlook

With only c.2% of leases due for expiry this year, we opine that CCT’s exposure to negative rental reversions are largely behind them. Expiring rents in 2019 and 2020 are c.2.8% and 14% lower than the expiring rents this year, and would support organic growth from positive rental reversions over the next two years. Interest rate risks are mitigated in the near term with zero debt expiring this year and 85% of debt on fixed rate.

Maintain Accumulate with unchanged target price of S$1.88

Our target price translates to a FY18e yield of 4.7% and P/NAV of 1.03x.

Source: Phillip Capital Research - 20 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024