Singapore Coal Monthly: Demand From China Still Robust

traderhub8

Publish date: Fri, 06 Jul 2018, 10:27 AM

China imports more coal

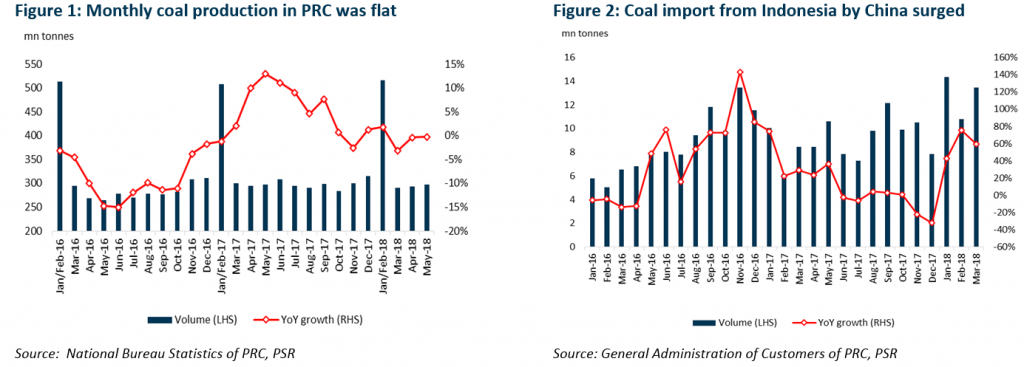

China imports surged: According to Reuters, China’s seaborne coal imports surged by 14% YoY in 1H18, estimating to reach 126.6mn tonnes. Indonesia became the biggest source of imports by delivering 61.8mn tonnes of coal, a jump of 33.5% YoY. Meanwhile, the imported coal from Australia remained flat at 42.8mn tonnes during the period (1H17: 42.6mn tonnes).

Import restrictions relaxed: In Jun-18, the central government has reduced restrictions on coal imports at the nation’s major ports in response to concerns about higher prices and regional power shortages, as demand for electricity jumps during the peak summer months. Ports in Shandong, Fujian and Guangzhou provinces have accelerated their clearance times to 10 days from 15 working days, and other ports across the country have similarly been told to prioritise handling coal for power generation.

Anti-pollution plans to curtail coal: In 3-Jul, the State Council announced the final version of the country’s 2018 to 2020 anti-pollution plan. The regions of Beijing, Tianjin, Hebei, Shandong and Henan will be required to cut coal consumption by 10% over the 2016 to 2020 period, while the Yangtze delta region will have to cut coal use by 5% over the period. No new capacity for steel, coke and primary aluminium production will be allowed in the regions through to 2020

Demand for coal outstripping supply in China

China’s domestic production continued to remain flat, as shown in Figure 1. Meanwhile, the demand for power remains strong, especially thermal power where demand resumed back up to double digits in May-18, as shown in Figure 3. The expected relaxation on seaborne coal imports, as mentioned in our previous monthly, boosted the stockpiles at Chinese ports, see Figure 6. In Jun-18, total port coal inventory jumped 49% YoY, indicating that thermal power demand will be much higher during the summer season which is expected to be longer this year (more than 4 months).

Apparently, the security of coal supply in the near term became the authority’s priority over any clampdown of coal prices. Coal price was back to the abnormal area over the last two months, see Figure 5. Given the seaborne coal will continue to fill up the supply gap during the peak season, coal prices are expected to stay elevated in 3Q18.

Indonesia coal market is expected to remain upbeat in 2H18

In terms of production, domestic miners produced a total of 145mn tonnes from Jan- to May-18, accounting for 31.7% of the annual target of 485mn tonnes (+5.2% YoY) set by Energy and Mineral Resources Ministry. In terms of price, HBA hit a 6-year high in Jul-18, touching US$104.7/tonne, shown in Figure 4. The HBA averaged at US$96.5/tonne in 1H18 with 17% YoY growth. We believe the strong demand for seaborne coal from China will keep coal price buoyant subsequently.

Coal counters monthly updates

Golden Energy and Resources (Target px: S$0.48 / BUY)

- Benefited from the buoyant coal prices in 1Q18

- Upgrading the port loading capacity

- Cash cost was higher than expected in 1Q18

- Cash position reached US$305mn as of 1Q18

Geo Energy Resources (Target px: S$0.41/ BUY)

- 11mn tonnes of production target is on track

- Cash cost will jump this year

- Remain upbeat on any near-term acquisition

- Cash position reached US$248mn as of 1Q18

Investment action

We remain positive on the sector as we expect coal price (FY18e ASP 4,200 GAR: US$42/tonne, 1Q18 ASP 4,200 GAR: US$52.4/tonne) will be favourable for coal miners. Meanwhile, the ramp-up of production is still on track. We maintain an OVERWEIGHT rating on the coal sector.

Phillip Coal Tracker: Our snapshot of coal markets

Source: Phillip Capital Research - 06 Jul 2018

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024