Thai Beverage: Accretive Acquisitions But Domestic Beer Demand Drags

traderhub8

Publish date: Thu, 17 May 2018, 05:07 PM

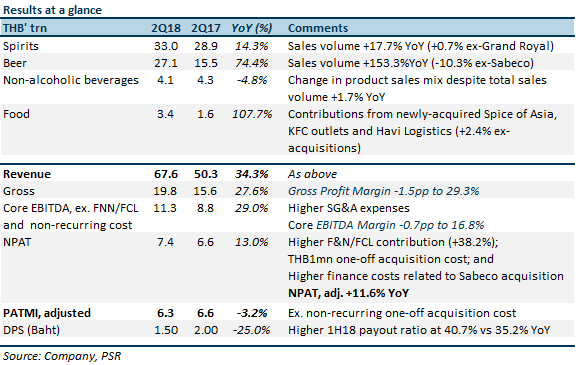

- 1H18 Revenue/Core EBITDA met 55%/50% of our full year expectations; Earnings missed on higher than expected finance costs and effective tax rate

- Strong results from recent acquisitions unable to offset the persistent weakness in Thai Beer market

- Introduction of a new excise tax of 2% for Elderly Fund since 26 Jan-18

- Proposed lower interim dividend of 0.15 baht per share (1H17: 0.20 baht)

- Maintained BUY with unchanged SOTP-derived TP of S$1.05

The Positives

+ Recent acquisitions fuelled growth. Acquired businesses contributed THB20.21bn and THB2.94bn to Group’s 1H18 Revenue and Profit, respectively. Pro-forma* contribution to 1H18 Revenue and Profit would have been THB130.98bn and THB12.50bn, respectively. *Assuming acquisitions since 1 Oct-17

- Spirits: PATMI +2.8% YoY driven by contribution from Grand Royal, offsetting the lower net profit from its existing Spirits business.

- Beer: Sabeco is earnings accretive. It contributed THB1.61bn or 13.7% to the Group’s 1H18 Net profit.

- Food: SOA, QSA and Havi Logistics contributed THB111.3mn or 34.1% to the Group’s 1H18 Net profit.

+ Improved liquidity, current ratio was up from 0.88x to 1.82x QoQ. THB50bn from the bridging loans obtained to fund the acquisitions was converted into long-term debts in Mar-18. The management intends to further refinance its short-term debts to long term.

The Negatives

– Existing Alcoholic Beverages segment disappointed – hit by double whammy of protracted weak demand and implementation of a new excise tax. Effective from 26 January 2018, all alcoholic beverages have been slapped with an additional 2% of excise tax by law to contribute to the Elderly Fund.

- Spirits: 1H18 Sales volume was down by 5.1% YoY, coupled with higher input costs and SG&A expenses, 1H18 Net profit margin decreased7pp YoY to 16.6%.

- Beer: Persistent weakness in domestic beer demand, increased SG&A expenses and introduction of new excise tax weighed on earnings. 6.0pp was shaved off 1H18 Net margin YoY to a mere 1.1%.

1H18 Sales volume for its existing beer business was down 8.3% YoY, in tandem with the 6.7% lower industry volume turnover. However, we take comfort of its stable beer market share in Thailand at c.38%.

Outlook

Near-term pressures but banking on 2018 FIFA world cup boost.

On-trade consumption for alcoholic beverages has yet to turnaround despite starting from a low base. While stronger Thai economy is not yet broad-based, the high household debt has eroded consumers’ purchasing power. Soft demand for alcoholic beverages in Thailand could extend for longer period. Nonetheless, we believe that the FIFA World Cup is likely to boost beer sales, not only in Thailand but also in Vietnam.

On the other hand, we do not expect gross margin to deteriorate further compared to 2Q18’s. The Group has already adjusted its Spirits prices for the additional excise tax by end Apr-18, but may refrain from increasing its Beer prices in near term, in view of fierce competition. Management also noted that pressure from domestic molasses prices seen in the past 12-months should subside in 2H18.

However, SG&A expenses should remain elevated, as advertising and promotional activities normalised to pre-mourning period level (before Oct-16).

Maintained Buy and SOTP-derived TP of S$1.05

With better clarity in 2Q18 upon conversion of short-term to long-term loans, we have adjusted for higher finance expenses, thus FY18e Adjusted PATMI to -3.9% vs previous forecast.

Potential re-rating catalysts:

- Higher economic interest of Sabeco.

- Margin expansion in conjunction with the excise tax hike.

- A faster turnaround in non-alcoholic beverages (the Group targets to breakeven by 2020).

- Unlocking value from potential synergies with partnership with Yum Thailand, Grand Royal Group, Sabeco, and Havi Logistics.

Source: Phillip Capital Research - 17 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024