SHS Holdings Ltd: Exporting Construction Technology

traderhub8

Publish date: Fri, 25 May 2018, 05:30 PM

- Expect a surge in modular business sourced from New Zealand

- Upcoming recurring revenue from a solar project in Bangladesh

- Recovery in marine and construction sector to support legacy businesses

- Initiate coverage with BUY rating with TP of S$0.29, based on FY19e EPS of 2.9 SCents and 10x PE multiple

Company Background

SHS Holdings Ltd (SHS) generates revenue from two existing business segments:

- Corrosion prevention of marine vessels and other steel structures;

- Structural steel for buildings.

We expect future growth will come from two new business segments:

- Modular construction under its Vietnam based subsidiary, TLC Modular. It manufactures steel prefabricated prefinished volumetric construction (PPVC) and prefabricated bathroom unit (PBU).

- A solar project in Bangladesh under subsidiary Sinenergy.

Investment Merits

1. Modular business boosted by strong demand in New Zealand. There is a huge shortage of housing in New Zealand – demand for new houses is around 18,000 p.a. while supply is struggling at 10,000. Since 2009, there has been a cumulative shortfall of nearly 44,700 units. We believe this gives TLC Modular an opportunity to penetrate the market by exporting its PPVC products to New Zealand. The speed and cost advantage makes it a compelling product, in our opinion. TLC recently announced two projects worth S$28m in New Zealand. Another project running is the Cosa hotel, estimated to complete in 2H18.

2. Recurring revenue from solar projects. SHS has secured a solar farm project under its subsidiary Sinenergy with the Bangladesh government, to provide 20 years of electricity. The 50 MW project was designed, constructed, financed, owned and operated by Sinenergy. We expect the project to generate a net profit of around S$4mn from FY19e.

3. Recovery of construction and oil & gas sector will contribute to SHS core revenues. The group’s Structural Steel and Corrosion Prevention businesses are heavily correlated to the construction and oil & gas sector. The recent protracted downturn of the marine, oil and gas sector has affected the group’s overall profitability. With crude oil prices starting to recover and the increase in construction activities, these segments are poised for a slow turnaround.

We initiate coverage on SHS with a BUY rating and a target price of S$0.29. We are pegging SHS to other construction companies with prefabricated and structural steel business in Singapore. Our target price is based on 10X FY19e PE. We gave a 10% discount on SHS to its peers as we take a more conservative approach in SHS’s valuation.

Background

SHS Holdings Ltd currently derives revenue from Corrosion Prevention, Structural Steel and Facade Engineering. However, future growth will mainly come from its two new business segments, i.e. Solar Energy and Modular Construction.

(i) Structural Steel Engineering engages in the design, engineering, and construction of steel and aluminium.

(ii) The Corrosion Prevention segment is involved in the coating and blasting of raw materials, mainly steel structures, steel plates and fabricated modules.

(iii) Solar Energy is operated under its subsidiary Sinenergy, which engages in the engineering, procurement and construction of solar power projects. It currently runs projects in Singapore and Bangladesh, both involved in the sale of solar electricity.

(iv) Modular construction is operated under its Vietnam based subsidiary, TLC Modular. It offers prefabricated construction solutions in the form of prefabricated prefinished volumetric construction (PPVC) and prefabricated bathroom unit (PBU).

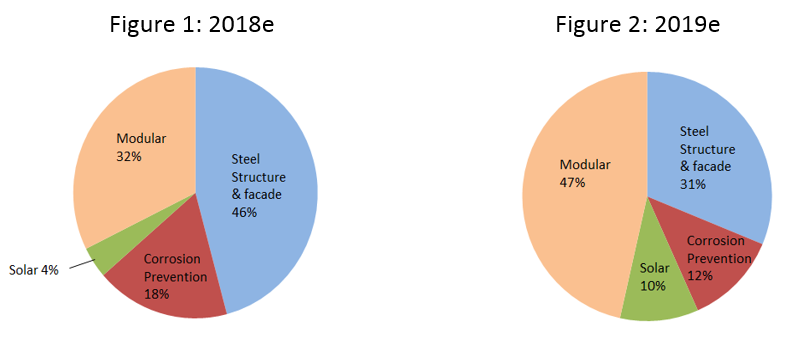

Revenue Breakdown by segments:

The Four Business Segments

1. MODULAR CONSTRUCTION

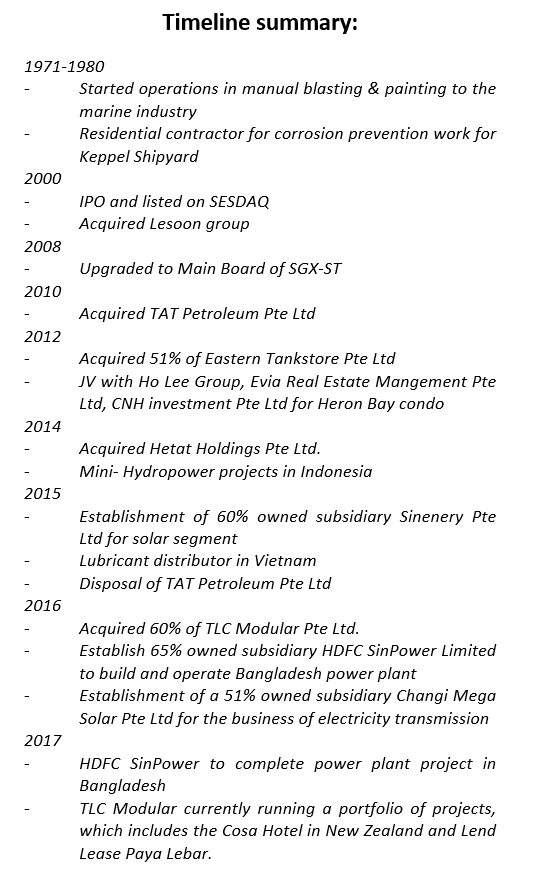

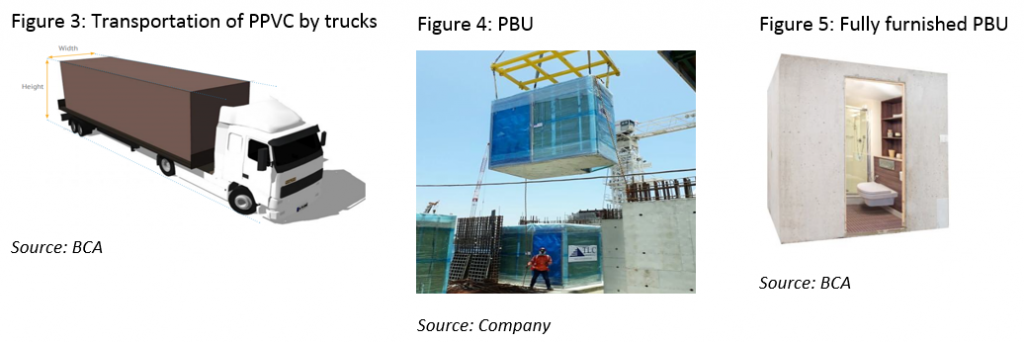

TLC Modular is located in Ho Chi Minh, Vietnam. Modular construction is a construction process where a building is constructed 90% off-site in a controlled factory environment. These units are then transported on-site to be pieced together into a building. Only 10% of work is required on-site. Trucks carrying the module to the site (Figure 3) can easily undertake transportation. Mechanical, electrical and plumbing work can be completed off-site such as air conditioning, internal wirings, lights and finished floors. TLC Modular’s 2 key products are steel PBU and PPVC (Figures 4, 5 and 8). Such modules can be used in the construction of residential houses, apartment, hotels, portable accommodation, cabins, commercial and office construction.

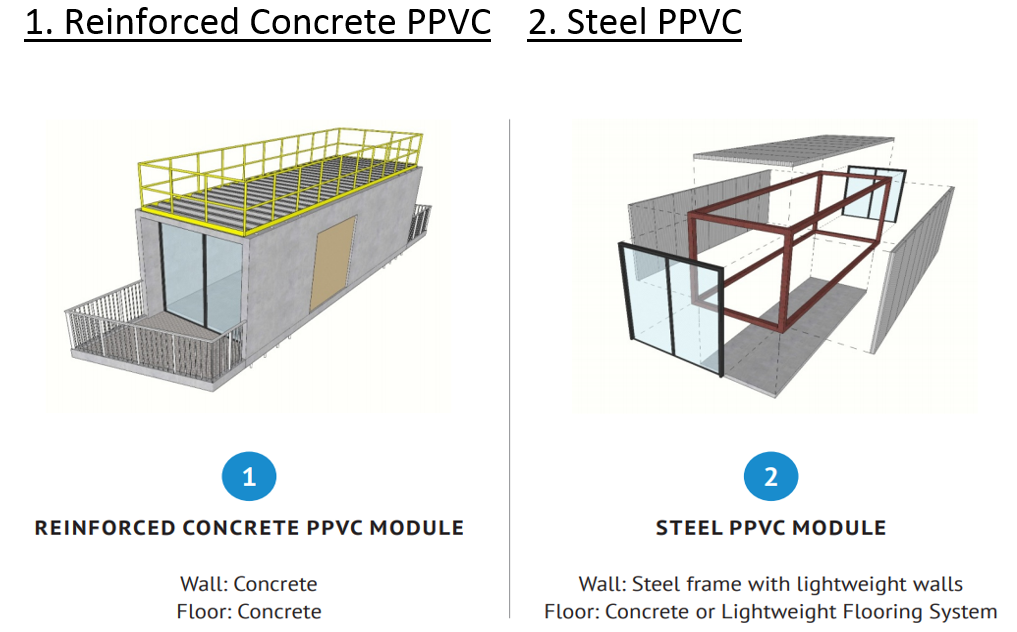

There are 2 broad types of PPVC:

Source: BCA

Source: Phillip Capital Research - 25 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024