China Aviation (Singapore) Oil: Stellar Growth From Pudong

traderhub8

Publish date: Fri, 11 May 2018, 05:22 PM

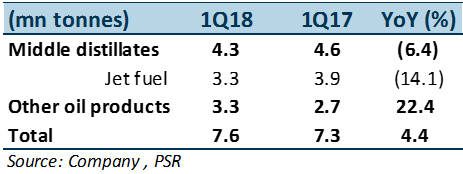

- 1Q18 net profit exceeded our expectation by 11.8% due to higher than expected profit from associates.

- Trading volumes were healthy and profits from associates at new highs.

- Backwardation persisted, compressing trading margins.

- CAO adopted SFRS (I) 9, which reports expected credit losses and changes. It made an impairment provision of US$1.57 million on receivables in 1Q18.

- We modestly raised FY18e EPS to 10.9 US cents (previously 11.0 US cents) after the impact of the adoption of SFRS (I) 9. Based on an average forward 12-month PER of 13.3x, we maintain our BUY call with an unchanged target price of S$2.00 for FY18.

Positives

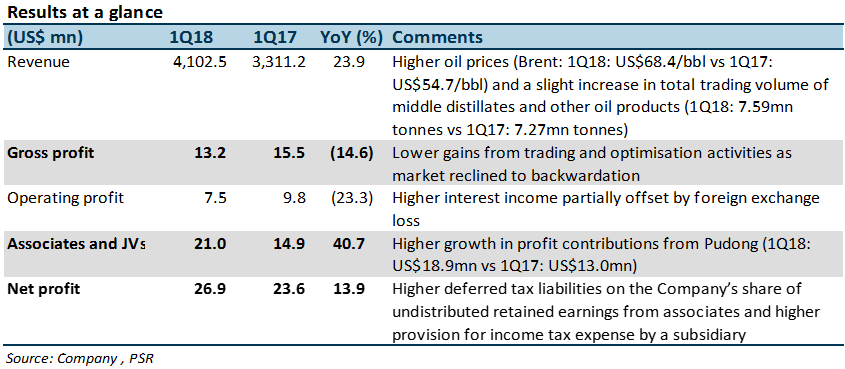

+ The scale of trading business keeps improving: CAO is building scale in trading business to achieve lower break-even point. Trading volume in other oil products mainly came from crude oil in 1Q18 (Figure 1).

Figure 1: Still expanding volumes

+ Profits from associates delivered a stellar growth: Profit from Pudong was US$18.9mn (+46% YoY) due to higher refuelling volume, foreign exchange gain and investment income. During the period, refuelling volume increased by 6.8% YoY to 1.1mn tonnes, and RMB appreciated against USD by 8% YoY. OKYC also improved their performance with 1Q profit of US$1.4mn, +6.9% YoY. CNAF HKR continued to shrink net losses to US$0.17mn, the lowest since the business was acquired in 2014.

Negatives

– Trading margins narrowed due to backwardation persisted: Despite the rise in total trading volume, GPM dropped by 14.6% YoY in 1Q18. With oil prices in backwardation, CAO slowed the rate of expansion in the trading business and became more selective in orders deemed more profitable.

Outlook

Oil prices are on a rising trajectory, and backwardation could continue for another 1 or 2 quarters. Hence, the growth of trading activities is expected to slow down. Meanwhile, trading margins will continue to face compression in the near term. Nonetheless, we remain upbeat on CAO as profit from associates, especially Pudong will deliver high growth rates continuously this year, driven mainly by more air traffic volumes that are attributable to the operation of the 5th runway.

Maintain BUY with unchanged TP of S$2.00

We modestly adjusted our FY18e EPS to 10.9 US cents (previously 11.0 US cents) due to the impact of the adoption of SFRS (I) 9. Based on an average forward 12-month PER of 13.3x, we maintain our BUY call with an unchanged target price of S$2.00 for FY18.

Source: Phillip Capital Research - 11 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | Jun 12, 2024

Created by traderhub8 | Jun 03, 2024