What You Need to Know about Meituan (SEHK:3690)

ljunyuan

Publish date: Wed, 07 Dec 2022, 01:38 PM

Meituan (美团) is another Hong Kong-listed company (under the ticker symbol SEHK:3690) I’m sure many fellow Singaporean retail investors are familiar with.

Listed on the Stock Exchange of Hong Kong since 20 September 2018, the company is China’s leading one-step platform for food, transportation, travel, shopping, and entertainment (I like to think of their app to be something similar to the ‘Grab’ super app we have in Singapore.)

Revenue for Meituan is derived from 4 business segments, along with their revenue contribution (in percentage terms) for the latest financial year 2021 ended 31 December in square brackets:

(i) Food Delivery Services – through its on-demand food delivery services [30%];

(ii) Commission – through a percentage of relevant transaction amount generated from sales of specified goods or services by merchants or third-party agent partners in its online marketplaces [30%];

(iii) Online Marketing Services – for this business segment, revenue is generated (and paid by the particular merchant) whenever someone clicks to find out more about its products and/or services, in addition to value-added marketing services which merchants take up (on Meituan’s online platform) under an annual plan [16%];

(iv) Other Services & Sales (including Interest Revenue) – this business segment encompasses sales of goods (mainly generated from business-to-business food distribution services and Meituan Grocery), as well as other services rendered including community e-commerce, bike-sharing, electric mopeds, ride-sharing, power banks, along with micro-credit and interest revenue [24%]

As you can see from the above, there is, in a way, some form of diversification in the company’s revenue sources – which is good to note.

However, this alone is not good enough for us to determine whether or not a company makes a good addition to our long-term investment portfolio. Let us now take a look at the company’s post-IPO financial performances and debt profile over the last 3 years (between FY2019 and FY2021) to find out whether out not it fits into our investment criteria:

Financial Performance between FY2019 and FY2021

In this section, you’ll learn about Meituan’s financial performance (in terms of growth in its total revenue and net profit attributable to shareholders, gross and net profit margins, along with return on equity) over the last 3 years:

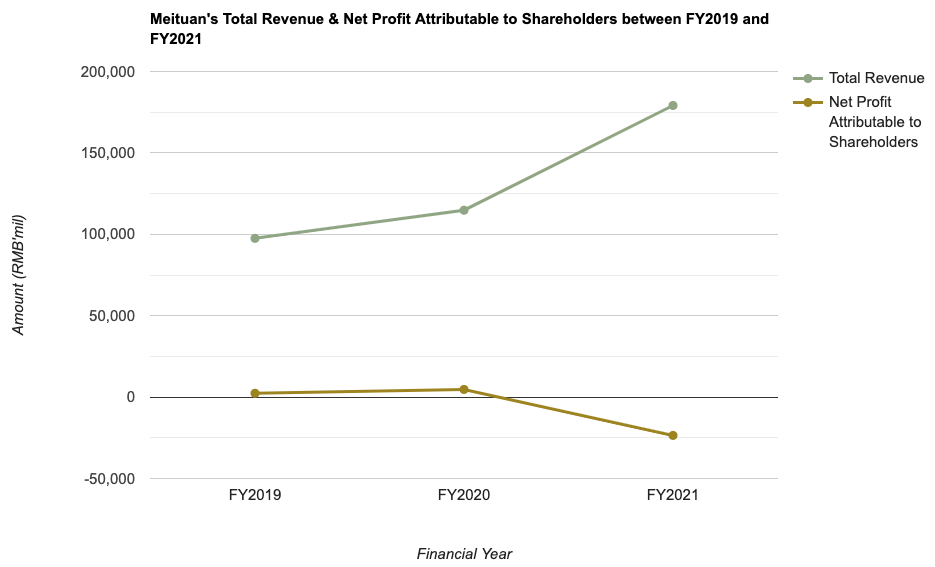

Total Revenue & Net Profit Attributable to Shareholders (RMB’mil):

| FY2019 | FY2020 | FY2021 | |

| Total Revenue (RMB’mil) | RMB 97,529m | RMB 114,795m | RMB 179,128m |

| Net Profit Attributable to Shareholders (RMB’mil) | RMB 2,239m | RMB 4,708m | RMB -23,539m |

My Observations: While total revenue saw an upward climb, and recording a compound annual growth rate (CAGR) of 22.5% over a 3-year period, its net profit attributable to shareholders fell into a loss in FY2021 – as a result of a fair value loss of RMB815.7m in its financial instruments (due to the fluctuation in valuation of their investment portfolios, as well as certain one-off valuation adjustment driven by capital transactions of certain investee in 2020), along with a loss of RMB185.7m in its other losses/gains.

Gross & Net Profit Margins (%):

The following table is Meituan’s gross and net profit margins I’ve computed:

| FY2019 | FY2020 | FY2021 | |

| Gross Profit Margin (%) | 33.1% | 29.7% | 23.7% |

| Net Profit Margin (%) | 2.3% | 4.1% | -13.1% |

My Observations: Due to a rise in cost of sales over the years (with the percentage more than that of total revenue), its gross profit margin have been on a downward decline over the last 3 years.

As far as its net profit margin is concerned, as the company fell into a net loss in FY2021, its net profit margin was at a negative percentage as well.

Return on Equity (%):

Return on Equity, or RoE for short, is a measure of the company’s ability to generate profits for every dollar of shareholders’ money it uses in its business(es). Personally, my preference is towards companies that are able to maintain a RoE at 15.0% or above over the years.

The following table is Meituan’s RoE between FY2019 and FY2021 which I have computed:

| FY2019 | FY2020 | FY2021 | |

| Return on Equity (%) | 2.4% | 4.8% | -18.7% |

My Observations: Meituan’s RoE for FY2021 fell into a negative percentage due to it recording a net loss for the financial year.

Debt Profile between FY2019 and FY2021

Apart from its financial performance, another thing I look at when I study a company is its debt profile – where my preference is towards companies that have minimal or no borrowings, and at the same time, in a net cash position.

This requirement is even more important now in this rising interest rate environment – with increased financing costs “eating” into a company’s bottom-line, particular for those who have a high amount of borrowing.

With that, let us take a look at Meituan’s debt profile between FY2019 and FY2021, as follows:

| FY2019 | FY2020 | FY2021 | |

| Cash & Cash Equivalents (RMB’mil) | RMB 13,396m | RMB 17,094m | RMB 32,513m |

| Total Borrowings (RMB’mil) | RMB 4,020m | RMB 8,352m | RMB 23,785m |

| Net Cash/Debt (RMB’mil) | RMB +9,376m | RMB +8,742m | RMB +8,728m |

My Observations: While the company is in a net cash position throughout the entire 3 year period I have looked at, it has been on a decline, as a result of a huge increase in its total borrowings.

However, I note that its current ratio have been maintained at above 1.5 throughout the entire 3-year period – meaning the company have no problem in fulfilling any short-term debt obligations.

Closing Thoughts

Ideal: Improvements in its total revenue over the past 3 years, along with a diversified revenue stream

Not So Ideal: Company fell into a net loss position in FY2021, gradual decline in its gross profit margin, as well as in its net cash position

In case you’re wondering, the company’s management declare any dividend payouts throughout the entire 3-year period.

Finally, for those who are looking to invest in the company, do note that its lot size is 100 (meaning you need to buy shares in multiples of 100), and at its current price of HKD174.20 at the time of writing, your minimum investment amount will be HKD17,420.00 (before any commissions charged by your brokerage platform) – this amounts to S$3,040.11, based on the currency exchange rate of HKD1.00 to SGD0.17.

With that, I have come to the end of my review of Meituan. I hope the contents above give you a better understanding about the company. As always, everything I’ve just shared is purely for educational purposes only, and it does not serve as any buy or sell calls for the company’s shares. You should always do your own due diligence before you make any investment decisions.

Disclaimer: At the time of writing, I am not a shareholder of Meituan.

More articles on THE SINGAPOREAN INVESTOR

Created by ljunyuan | Aug 12, 2024