Keppel DC REIT - Acquisition Growth Booster

simonsg

Publish date: Tue, 17 Jul 2018, 10:37 AM

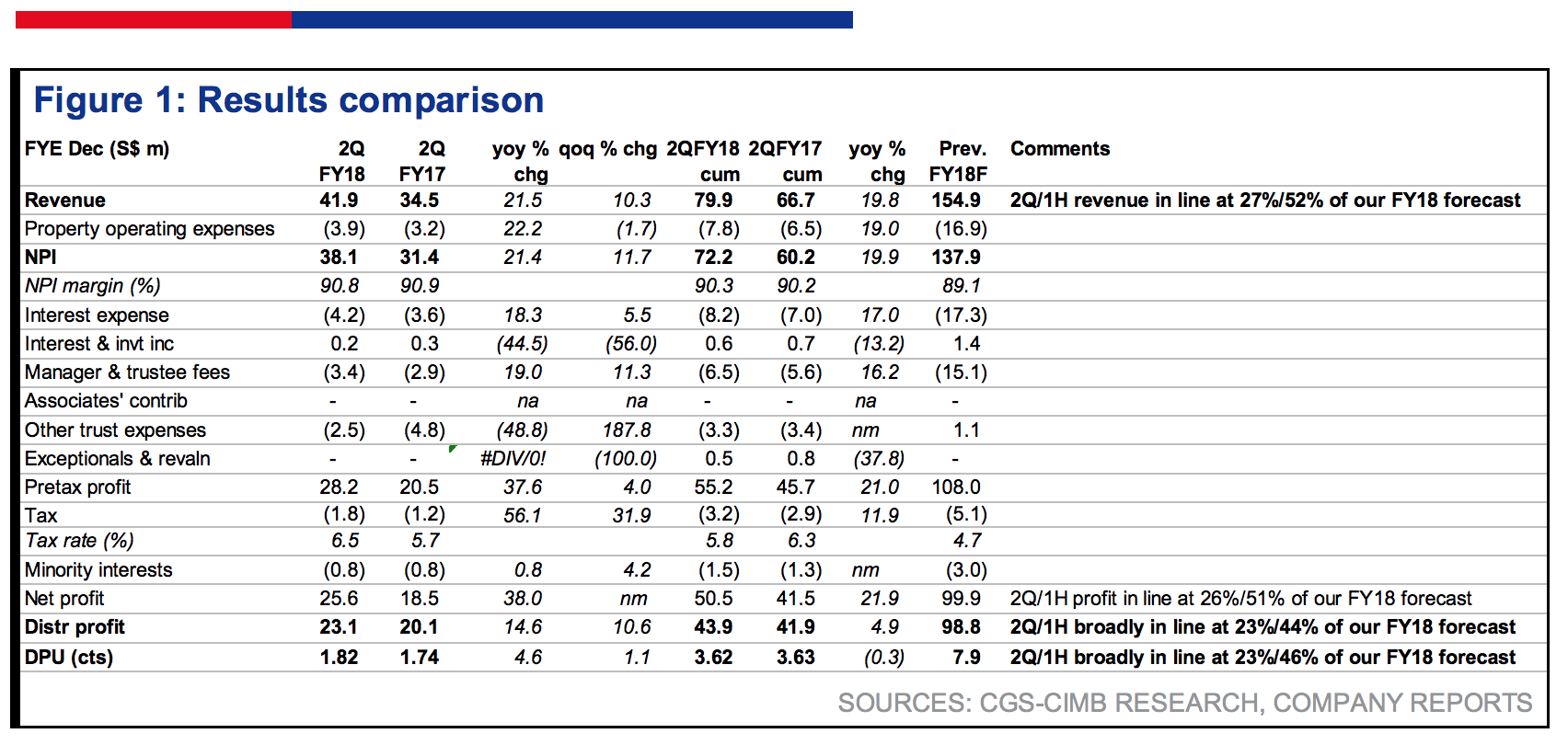

- Keppel DC REIT's 2Q18 DPU broadly in line with expectations, at 23% of our FY18 forecast.

- Keppel DC REIT's 1H18 DPU at 46% of our FY18 forecast.

- Topline boost came mainly from new acquisitions.

- Low gearing of 31.7% provides debt headroom for new acquisition opportunities.

- Maintain ADD with an unchanged Target Price of S$1.49.

2Q18 Results Highlights

Keppel DC REIT (KDCREIT)’s 2Q18 results were broadly in line, with DPU of 1.82 Scts (+4.6% y-o-y), making up 23% of our FY18 forecast. The improvement was underpinned by a 21.5% rise in gross revenue and 22.2% rise net property income, albeit partly offset by higher finance costs and Manager’s fees.

At halftime, its cumulative DPU of 3.62 Scts is 4% higher y-o-y, after adjusting for the one-time capital distribution in 1Q17.

Boosted by New Contributions From Recent Acquisitions

2Q18 topline growth was driven largely by contributions from new additions such as maincubes Data Centre (acquisition completed in Mar 2018), and recent purchase of 99% interest in KDC SGP5 (formerly known as Kingsland Data Centre) and Dublin 2 (DUB2) as well as forex strength. There was also higher variable income from the other data centres in its portfolio - SGP1, SGP2, SGP3 and higher rental income from DUB1.

This was partly offset by lower rental income from Basis Bay Data Centre.

High Portfolio Occupancy

Portfolio occupancy remained fairly high at 92% in 2Q18, although it dipped slightly on a q-o-q basis. There was occupancy improvements at SGP 1 (+2.6% pts to 87.3%) while SGP 5’s underlying occupancy rose to 73.9%.

With minimal lease expiries of 1.2-4.8% annually between FY18-20F, we anticipate Keppel DC REIT (KDCREIT)’s income to remain relatively stable.

Lower Gearing Post Recent Equity Raising

With its recent private placement in May 2018, Keppel DC REIT (KDCREIT)’s gearing has improved to 31.7% as at Jun, which provides the REIT with a potential debt headroom of S$290m, assuming an optimal gearing level of 40%. This puts it in a good position to explore new acquisition opportunities.

Moreover, its foreign-sourced distributions are hedged till 2H19, providing the REIT with good income visibility.

Maintain ADD

We leave our FY18-20F DPU unchanged post results. Our ADD rating and DDM-based Target Price of S$1.49 are maintained.

We continue to like Keppel DC REIT (KDCREIT) for its exposure to the positive fundamentals of data centres as well as potential for acquisitive growth.

Potential re-rating catalysts are accretive acquisitions.

Downside risk could come from unexpected rate hikes.

Source: CGS-CIMB Research - 17 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|