UOL Group Ltd - Oversold

simonsg

Publish date: Fri, 06 Jul 2018, 11:00 AM

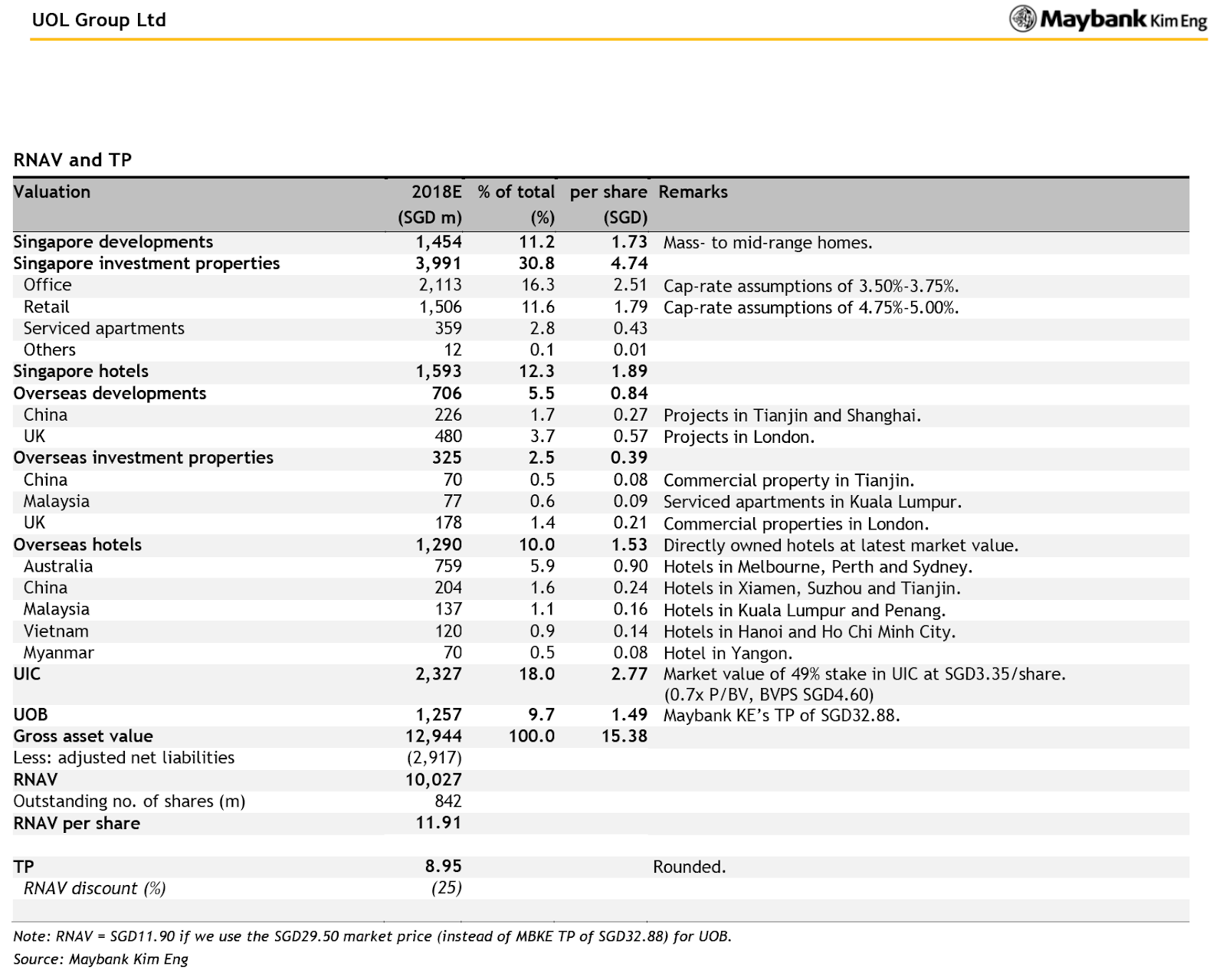

Maintain BUY; Target Price SGD8.95

- We cut Target Price to SGD8.95, based on a revised RNAV discount of 25% (from 10%).

- Our RNAV estimate is lowered by 1.2% to SGD11.91 after downgrading our ASP assumptions. Our FY18-20E EPS is cut by up to 9%.

- With the stock trading at over 40% discount to its RNAV, we believe the knee jerk reaction to policy tightening may have over-compensated for headwinds to its residential projects.

- Maintain BUY. UOL remains as our top pick amongst Singapore developers.

Cutting ASP Assumptions

With a 5-10% increase in ABSD for property investors, we expect developers to lower ASPs to stimulate demand.

We cut ASP for The Tre Ver (former Raintree Gardens) by 5% to SGD1,560 psf. As the site was acquired prior to land price escalation in the vicinity, we continue to see double digit margin for this project.

We cut our assumptions for Silat Avenue site by 7% to SGD2,050 psf. Nanak Mansion, a high-end project in the East Coast is cut by 13%.

Cheaper Proxy to Office Recovery

Including its pro-rata stake in UIC, UOL offers a 29% aggregate exposure (by value) to Singapore’s office market. At 0.6x P/BV and 42% discount to its RNAV, we believe UOL is a much cheaper proxy to a recovering office market than office REITs which are trading close to book values.

Furthermore, with the company recently gaining statutory control of UIC, repositioning and redevelopment potential within its commercial portfolio remains an attractive medium term theme.

Source: Maybank Kim Eng Research - 06 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|