United Overseas Bank Limited – Non-interest Income Growth Offset NII Decline

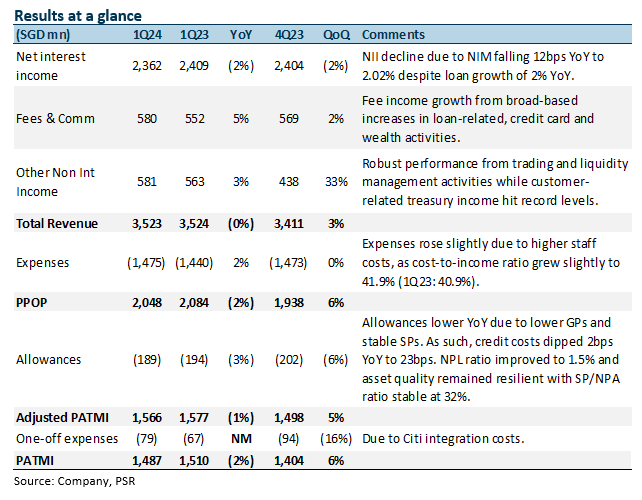

- 1Q24 adjusted earnings of S$1,566mn met our estimates as higher fee income and other non-interest income were offset by lower-than-expected NII and higher expenses. 1Q24 adjusted PATMI was 25% of our FY24e forecast.

- Positives include fee income growth of 5% YoY, trading and investment income rising by 10% YoY, and allowances dipping 3% YoY, while negatives were NII declining by 2% YoY as NIMs fell 12bps. UOB has maintained their FY24e guidance of low-single-digit loans growth, NIM to come in above 2%, double-digit fee income growth, stable cost-to-income ratio of around 41-42% and credit cost at the lower end of 25-30bps.

- Maintain BUY with an unchanged target price of S$34.90. Our FY24e estimates remain unchanged. We assume 1.41x FY24e P/BV and ROE estimate of 13.9% in our GGM valuation. FY24 will be another year of growth from stable NIMs, loan recovery, and double-digit fee income growth, which will boost earnings.

The Positives

+ Fee income continues to grow. Fees grew 5% YoY, largely due to higher loan-related fees of S$244mn (+3% YoY) and a pickup in wealth management fees to S$164mn (+6% YoY) due to a return in investor confidence. Notably, wealth management assets under management (AUM) grew 11% YoY to S$179bn. Credit card fees continued to grow, reaching S$90bn in 1Q24 (+11% YoY) but normalized from last quarter’s seasonal high (-28% QoQ). Fee income makes up 16% of total income (1Q23: 16%).

+ Trading and investment income rose 10% YoY. The growth was led by customer-related treasury income hitting a record level of S$219mn (+8% YoY) from increased retail bond sales and strong hedging demands, while trading and liquidity management activities continued to perform well (+11% YoY). Customer-related treasury income makes up 42% of trading and investment income (1Q23: 43%). Other non-interest income was up 3% YoY and 33% QoQ.

+ Credit costs and new NPAs dip YoY. Credit costs dipped 2bps YoY to 23bps as total allowances fell slightly by 3% YoY, mainly from a decline in SPs (-4% YoY) on lower NPL formation, while GPs remained stable. New NPA formation fell by 17% YoY to S$249mn as asset quality stabilised during the quarter. NPL ratio improved by 10bps YoY and remained stable QoQ at 1.5%. Asset quality remained resilient, with SP/NPA stable at 32%. 1Q24 NPA coverage is at 99%, and unsecured NPA coverage is at 204%.

The Negative

– NII declines YoY as NIMs soften. NII dipped 2% YoY from NIM falling 12bps YoY to 2.02% mainly due to loan margin compression due to competition for high-quality credits and high cost of funding as the impact from the recent deposit repricing has yet to be felt. Nonetheless, interbank and securities margin remained stable at 1.11% from active management of excess liquidity. Loans grew slightly by 2% YoY, driven by selective good credits and short-term trade loans.

Source: Phillip Capital Research - 9 May 2024