Singapore Stock Market News

Singapore Post - Delivering better profitability

StockFanatic

Publish date: Wed, 08 Aug 2018, 01:11 PM

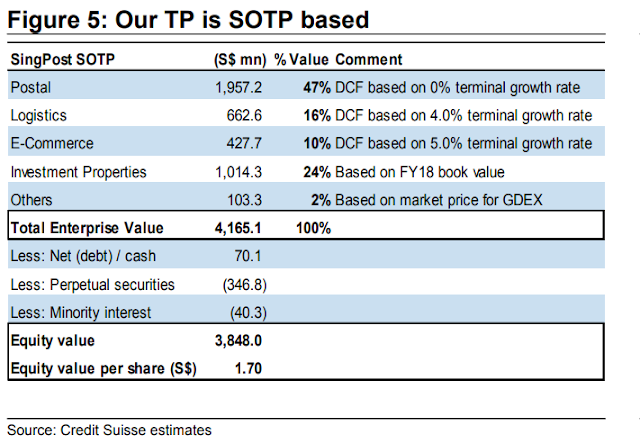

■ We assume coverage of SingPost with an OUTPERFORM rating and a SOTP based target price of S$1.70. With the domestic postal business facing structural headwinds, SingPost is transitioning to one of the leading ecommerce logistics providers in Asia. We believe current market valuation is underappreciating SingPost's logistics/e-commerce segments following recent setbacks in the transformation journey. We forecast SingPost's earnings (and hence dividends) to resume growth from FY19 onwards, led by the postal and logistics segments and narrowing of losses in e-commerce.

■ Postal EBIT likely to see revival in growth. Postal is passing through a transitory phase with the growing contribution from the low-margin international mail business (coming from Alibaba). Postal operating profit declined at a three-year CAGR of 3.4% due to the transition, despite revenue growth. However, we believe signs are emerging for postal operating profit to resume growth over the next three years (CAGR of c.4%) with international mail eventually offsetting the pressure on the domestic business.

■ Logistics/e-commerce to witness improved performance. Logistics and e-commerce segments have been hampered by the competitive and structural issues in QSI and TradeGlobal businesses, respectively. We believe the new management has taken corrective measures and expects improved performance over the next three years. Unlike postal, logistics is yet to witness meaningful benefit from collaboration with Alibaba. We see a strong growth potential from such partnership in the long term. However, SingPost may need to make more investments to fully realise the promise.

■ Our TP is SOTP based. We value postal, logistics and e-commerce using DCF, investment properties at BV, and 11.2% stake in GDEX at market valuation. SingPost appears expensive on the traditional P/E multiple. However, we believe P/E does not capture the changing business mix. We estimate market is only ascribing a EV/Sales of 0.26x to logistics and e-commerce vs an average of 1.62x for the peers.

Key risks are:

(1) execution,

(2) slower-thanexpected ramp-up in postal, logistics and e-commerce, and

(3) M&A.

Source : Credit Suisse Asia Pacific Equity Research

(Read Report)(Kindly make a donation first to unlock this report, deeply appreciated. Email stockfanaticsmartinvestor@gmail.com for password.)

■ Postal EBIT likely to see revival in growth. Postal is passing through a transitory phase with the growing contribution from the low-margin international mail business (coming from Alibaba). Postal operating profit declined at a three-year CAGR of 3.4% due to the transition, despite revenue growth. However, we believe signs are emerging for postal operating profit to resume growth over the next three years (CAGR of c.4%) with international mail eventually offsetting the pressure on the domestic business.

■ Logistics/e-commerce to witness improved performance. Logistics and e-commerce segments have been hampered by the competitive and structural issues in QSI and TradeGlobal businesses, respectively. We believe the new management has taken corrective measures and expects improved performance over the next three years. Unlike postal, logistics is yet to witness meaningful benefit from collaboration with Alibaba. We see a strong growth potential from such partnership in the long term. However, SingPost may need to make more investments to fully realise the promise.

■ Our TP is SOTP based. We value postal, logistics and e-commerce using DCF, investment properties at BV, and 11.2% stake in GDEX at market valuation. SingPost appears expensive on the traditional P/E multiple. However, we believe P/E does not capture the changing business mix. We estimate market is only ascribing a EV/Sales of 0.26x to logistics and e-commerce vs an average of 1.62x for the peers.

Key risks are:

(1) execution,

(2) slower-thanexpected ramp-up in postal, logistics and e-commerce, and

(3) M&A.

Source : Credit Suisse Asia Pacific Equity Research

(Read Report)(Kindly make a donation first to unlock this report, deeply appreciated. Email stockfanaticsmartinvestor@gmail.com for password.)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Singapore Stock Market News

Market Commentary: Record highs on trade, vaccine developments

Created by StockFanatic | Aug 26, 2020

Market Commentary: Record highs on trade, vaccine developments

Created by StockFanatic | Aug 26, 2020

Market Commentary: Data help US market end week on a high note

Created by StockFanatic | Aug 24, 2020

Market Commentary: Data help US market end week on a high note

Created by StockFanatic | Aug 24, 2020

Market Commentary: And they are back, with S&P within inches of record high close

Created by StockFanatic | Aug 13, 2020

Market Commentary: And they are back, with S&P within inches of record high close

Created by StockFanatic | Aug 13, 2020

Market Commentary: US negotiations over stimulus continue amid diplomatic tensions

Created by StockFanatic | Aug 11, 2020

Market Commentary: US negotiations over stimulus continue amid diplomatic tensions

Created by StockFanatic | Aug 11, 2020

Discussions

Be the first to like this. Showing 0 of 0 comments