The Week Ahead June 2022 - [STI, HSI, NASDAQ & S&P]

humblestock

Publish date: Sun, 19 Jun 2022, 03:24 PM

Fed has raised rates by 0.75% on persistent inflation. Inflation wasn’t slowing down in June which left the fed to increase increase rates by 0.75%. Markets continue to look upon inflation numbers and if it doesn’t slow down then more rate hikes are going to be expected with the next one in July. An interesting thing that we’ve been mentioning is that despite US making new lows, the Hong Kong market which we’ve been covering extensively has actually been resilient. With good news flowing out of HK we continue to be bullish and believe in the recovery of that market.

HSI

HSI has retraced to our short term uptrend line but is currently resisted at the 5ema. It has formed a higher low which is healthy in a larger reversal cycle. For long term holders, congrats as HSI is finally seeing some positive light with positive news flow coming out more and more. Even with the recent downside in US, HK has been holding up well with 20k a good support to continue to scale in. For this week, a break above the 5ema might signal more bullish signal and a test of 22k might be possible.

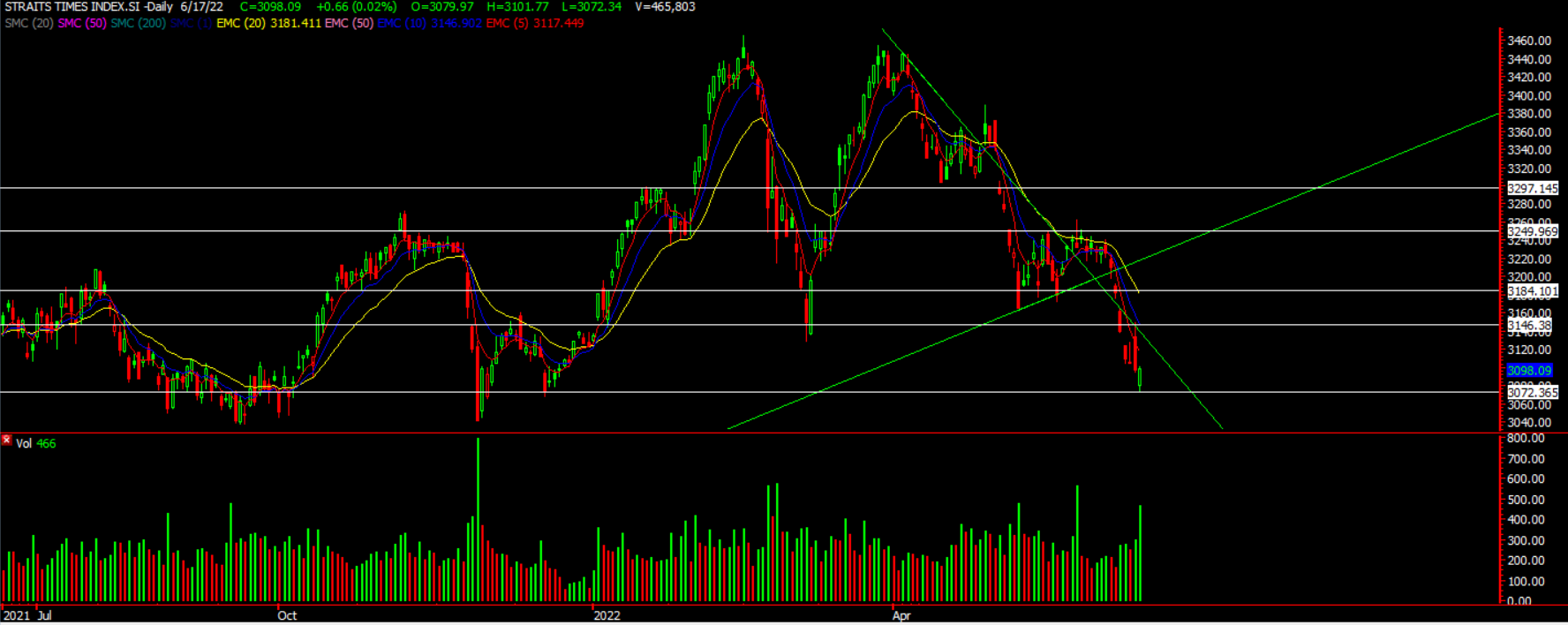

STI

STI has hit some some around 3072 but a more significant support is around 3035 area. That is a still a chance that STI might hit that support before any sustained rebound that comes. Singapore markets is still trying to find its footing and there hasn’t been any sustained rally so far. STI might rally to that downtrend line of around 3120 before getting resisted. We’ll await more confirmation before making any moves.

Head over to our facebook for more updates on S&P500 and Nasdaq for the potential levels we are looking at.

Yours

Humbly

Kelwin & Roy

The post The Week Ahead June 2022 - [STI, HSI, NASDAQ & S&P] appeared first on Singaporehumblestock.

More articles on Singapore Humble Stock

Created by humblestock | Jun 06, 2024