How To Invest Into The China Market? ChinaA50 or CSI300?

humblestock

Publish date: Wed, 04 Nov 2020, 07:00 AM

How To Invest Into The China Market? ChinaA50 or CSI300?

If biden wins the election there could a more measured approach towards foreign policy, which china and the rest of the asia market could potential benefit from. Lesser crazy tweets and tariffs!

If trump wins, foreign policy and tariffs would probably still be enforced but China being the second largest economy could still see so much more growth. So let’s take a look at how one can invest into the china market and diversify their portfolio.

INTRODUCTION

China is now the world's second largest economy and in October 2020, it's stock market has shown resilience despite covid-19 and exceeded US$10 trillion in total capitalisation just behind US. Therefore having exposure and having China as part of your investment portfolio makes good sense.

However, China market is still not easily available to foreign investors. Imagine if it opens up and allow more foreign investors to invest in it!! So today we shall look at some of the indices to gain access to the China Stock Market.

China A50 & CSI 300

China has 2 main Stock exchanges namely the Shanghai Stock Exchange and the Shenzhen Stock Exchange. Shares are mainly classified as A-shares (RMB-denominated common shares) which refer to ordinary shares, subscribed and traded in RMB or B-shares (which refer to RMB-denominated special shares subscribed and traded in foreign currencies and are more widely available to foreign investors). Both A and B shares are issued by companies incorporated and listed in mainland China. Most companies listed in China are the A-shares.

China's Largest Stock Exchange, the Shanghai Stock exchange has around 1564 companies listed in its Main A share market with many of the company listed there being the larger, state-own companies.

The Shenzhen Stock Exchange while being the smaller of the 2 exchanges has around 2,322 companies listed with the smaller, more entrepreneurial companies and many tech companies listed there.

The 2 most common indices for foreign investors to get access are the

FTSE China A50 index by FTSE Russell and CSI 300 index by China Securities Index Co.

FTSE China A50 index started in 2003 and it comprises the largest 50 A Share companies by market capitalisation of the securities listed on both the Shanghai and Shenzhen stock exchanges.

The CSI 300 index started in 2005 and it comprises of the 300 largest stocks listed on Shanghai and Shenzhen stock exchanges by market capitalisation, representing about 70% of the total market capitalization of the two exchanges. It is considered the blue-chip index for mainland China stock exchanges.

Comparing China A50 & CSI 300

To gain a better understanding of which of the two indices is more suitable, we shall compare the industry breakdown as well as how much the overall weightage of the top 10 holdings in each index.

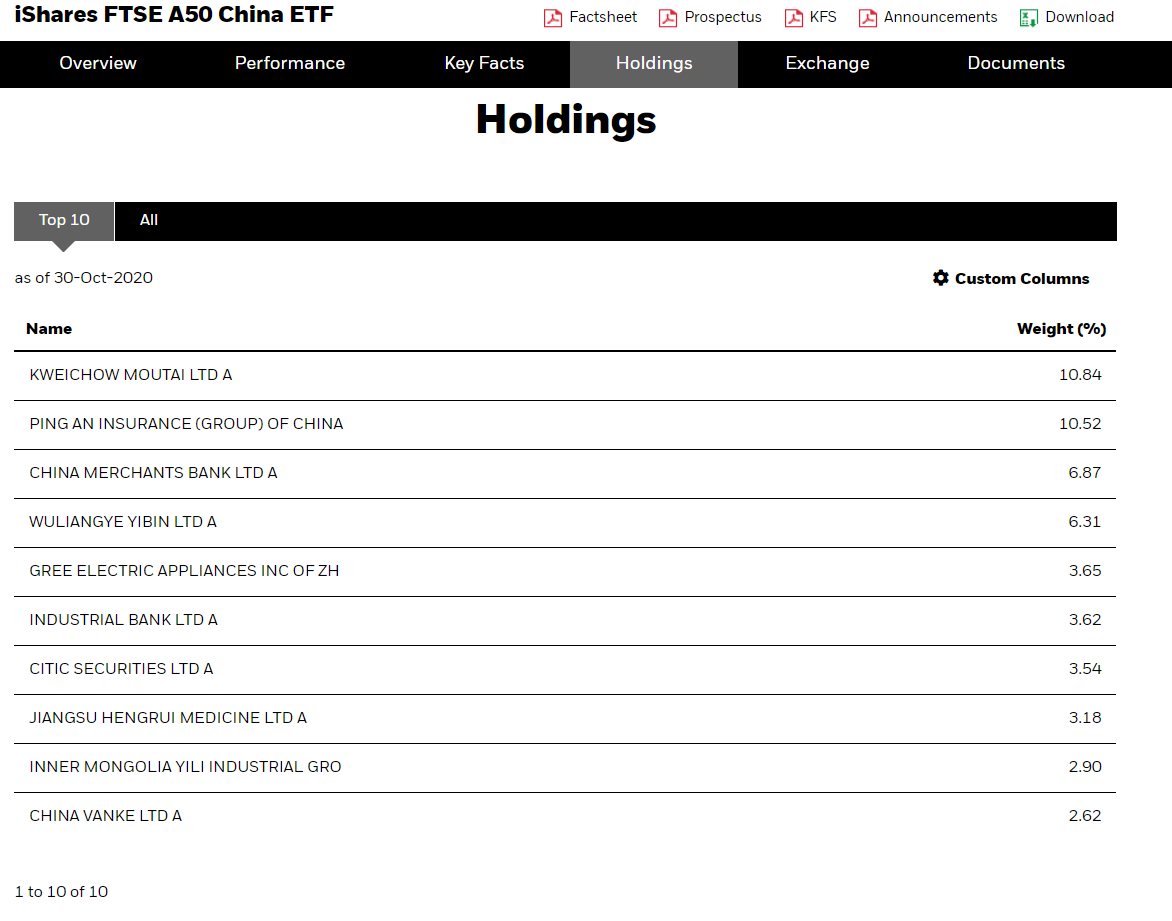

We used the iShares FTSE A50 ETF ( ticker code 2823) which is the largest china a50 ETF listed in HK with $16.43 billion for the sector breakdown as we couldn’t get much info on the A50 on the website.

From the 2 indices sector breakdown between China A50 Index and CSI 300 index:

- Financial sector form almost half of the China A50 index with 42% of the index while it form only around one-third of the CSI300 index at around 32%. That means any movement in financial sector stocks in the A50 index will have a much bigger impact on its performance compare to the CSI 300 index

- The Top 3 sectors of Financial , Consumer Staples and Consumer Discretionary constituted almost 74% of the China A50 index while the Top 3 sectors ( Financial, Consumer Staples and Industrials) on the CSI 300 index comprise of about 58.7% slightly more than half of the index but much less concentration compare to the A50 index. This means the impact of each of the Top 3 sectors on the CSI 300 index is less compare to the Top 3 sector impact on the China A50 index

Weightage of up and coming sector in the new economy such as Information Technology and Healthcare have almost 20% weightage in the CSI300 index (19.03%), while they only made up about 12% weightage in the China A50 Index (11.77%)

Next, we look at the Top 10 holdings in the 2 indices to see how they may impact the respective indices:

We can see that in the China A50 index the Top 10 holdings comprise of 54.05% of the index which is more than half of the index, while Top 10 holdings of the CSI 300 index only comprise of 25.53% of the index. This is less than of the weightage in the Top 10 holdings as compared to holdings in the China A50 index. This means any significant movement in the Top 10 holdings in CSI 300 index will have less impact on the Index as compared to the China A50 index, making it more diversified as compared to the China A50 index.

Concluding Thoughts:

After making the comparison ,we can see that the CSI 300 index has 6 times more stocks covered. It’s a little bit like dow 30 and S&P 500, which most investors tend to look at S&P500 as it gives a broader scope of the economy.

The financial sector also has a major concentration in the China A50 index compared to the CSI 300 index, with the Top 3 sectors stocks already covering almost 3 quarters of the China A50 index. Also , with new and emerging economy sectors like Information technology and Healthcare, the CSI300 better represent these changes

Lastly, the Top 10 holdings concentration in the China A50 index is more than half of the index as compared to the Top 10 holdings in the CSI 300 index which is about a quarter of the index. This means that China A50 index is more easily affected by the movement of a few leading stocks, which can exacerbate the volatility of the index as compared to the CSI 300 index.

As such, We are of the view that the CSI 300 index is a better choice index to invest in the China Stock market givign a more balanced view compared to the China A50 index.

In the next few blog post, we will look at some of the Etfs that we can invest for the CSI 300 index and other Etfs like KWEB(KraneShares CSI China Internet ETF), KURE (KraneShares MSCI All China Health Care Index ETF). And how you can use poems to invest directly into China Shares.

Stay tune!

Yours

Humbly

Kelwin&Roy

The post How To Invest Into The China Market? ChinaA50 or CSI300? appeared first on Singaporehumblestock.

More articles on Singapore Humble Stock

Created by humblestock | Jun 06, 2024