SGX Singapore Stocks & Forex Live Picks

SGX Technical Analysis Outlook 16th Oct

Your Advisor

Publish date: Thu, 16 Oct 2014, 07:50 PM

Market Review for STI:

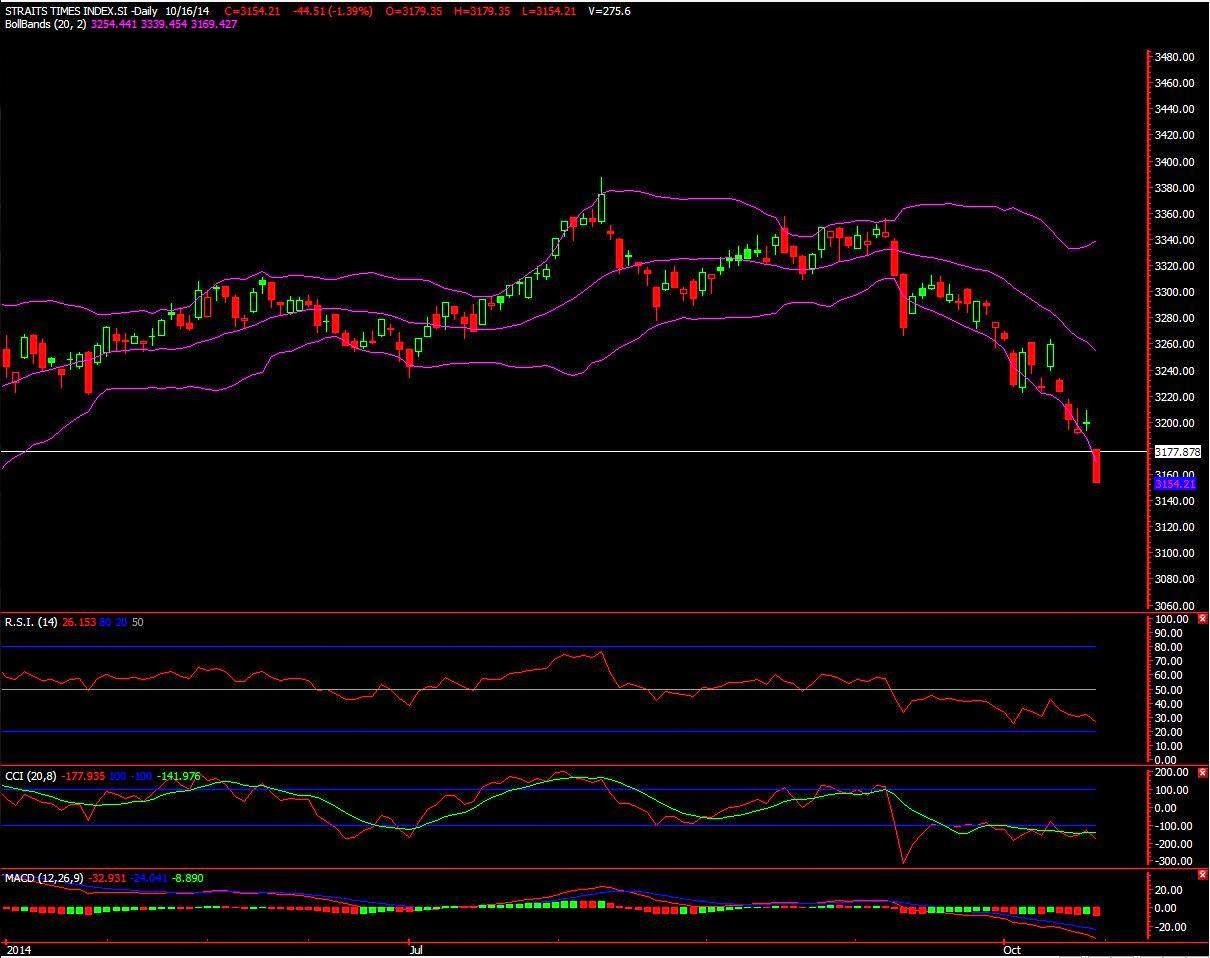

STI gave a gap down opening at 3179.35 and fell 1.04 per cent to 3,165.3 just half an hour into trading today's morning. This followed in the footsteps of US stocks which fell on Wednesday (early Thursday morning, Singapore time) on continued worries over the global economy and the spreading Ebola epidemic. Shares ended higher on Thursday with the benchmark Straits Times Index down 44.51 points to close at 3,154.21.

Important Factor for today:-

STI gave a gap down opening at 3179.35 and fell 1.04 per cent to 3,165.3 just half an hour into trading today's morning. This followed in the footsteps of US stocks which fell on Wednesday (early Thursday morning, Singapore time) on continued worries over the global economy and the spreading Ebola epidemic. Shares ended higher on Thursday with the benchmark Straits Times Index down 44.51 points to close at 3,154.21.

STI Day Performance | |

| Open | 3179.35 |

| High | 3179.35 |

| Low | 3154.21 |

| Close | 3154.21 |

| Change(Points) | -44.51 |

| % Change | -1.39% |

| Volume | 1335.2M |

| Rise | 69 |

| Fall | 389 |

| Unch | 679 |

Market forecast for STI:

The continued worrying issues in the global economy pulled the market down and we may expect the same situation till the impact eases. The market can further dip down as it is continuously breaking the supports.

The continued worrying issues in the global economy pulled the market down and we may expect the same situation till the impact eases. The market can further dip down as it is continuously breaking the supports.

STI LEVELS | |||||

| Support 1 | Support 2 | Support 3 | Resistance 1 | Resistance 2 | Resistance 3 |

3143.09 | 3118.44 | 3083.13 | 3187.09 | 3221.42 | 3259.5 |

Technical Indicators:

RSI is below the centre line and is at 44.38 and CCI is at -38.41.

RSI is below the centre line and is at 44.38 and CCI is at -38.41.

Top Gainers | Top Losers | ||||

Scrip Name | CMP | %change | Scrip Name | CMP | %change |

| CAPITAMALL TRUST.SG | 1.925 | 0.26 | KEPPEL CORP.SG | 9.54 | -3.73 |

| SPH.SG | 4.16 | -0.24 | COMFORTDELGRO.SG | 2.36 | -3.28 |

| CITYDEV.SG | 9.24 | -0.32 | OLAM INTL.SG | 2.14 | -3.17 |

| SIA.SG | 9.65 | -0.41 | NOBLE.SG | 1.23 | -3.15 |

| SIA ENGINEERING.SG | 4.42 | -0.45 | SEMBCORP IND.SG | 4.82 | -3.02 |

- Singapore, the world's largest bunkering port, plans to supply liquefied natural gas (LNG) to fuel ships by 2020, a government official said on Wednesday, as part of a global trend to move away from oil to gas to reduce emissions. "We are working towards LNG bunkering in Singapore by 2020, hopefully earlier if possible," Minister for Transport Lui Tuck Yew said at an industry event.

- TOURISM receipts grew 2 per cent year on year in the first half of this year to S$11.8 billion, even as visitor arrivals to Singapore fell 3 per cent to 7.5 million. Stripping out China, visitor arrivals from all other markets were up 2 per cent in H1 14. But in Q2 14, tourism receipts were down 3 per cent year on year to S$5.6 billion while visitor arrivals declined a sharper 6 per cent to 3.6 million.

- RETAIL sales expanded 5.4 per cent year on year in August, lifted by sales of motor vehicles, without which overall sales would have dipped 1.6 per cent. According to a release from the Department of Statistics (DOS) on Wednesday, sales of vehicles were up by as much as 49.5 per cent year on year and 13.1 per cent month on month. Month on month, retail sales (seasonally adjusted) were up 5.3 per cent in August, again bolstered by sales of motor vehicles. Stripping out motor vehicles sales, retail sales increased 3.5 per cent. The total retail sales value for August came to S$3.2 billion, up from S$3 billion a year ago, said DOS.

- Inflation in China fell to 1.6 per cent in September, the government said Wednesday, below analysts' forecasts and the lowest in the world's second-largest economy for almost five years. The consumer price index (CPI) figures released by the National Bureau of Statistics represented a slowdown in inflation from 2.0 per cent in August. It was the lowest since January 2010. Analysts polled by Dow Jones Newswires had predicted 1.7 per cent. The figures fall well short of the 3.5 per cent annual target set by the government in March, and signal that deflationary pressures are rising.

More articles on SGX Singapore Stocks & Forex Live Picks

There's No Recession, but a Market Correction Could Cause One

Created by Your Advisor | May 10, 2017

TECH TARGETS: EUR/USD, GBP/USD, USD/JPY, AUD/USD, NZD/USD - UOB

Created by Your Advisor | Mar 23, 2017

M Asia Trade Tech Targets: EUR/USD, AUD/USD, NZD/USD, USD/JPY - UOB

Created by Your Advisor | Mar 22, 2017

Discussions

Be the first to like this. Showing 0 of 0 comments