SGX Singapore Stocks & Forex Live Picks

Daily KLCI Technical analysis Report 23 July

Your Advisor

Publish date: Wed, 23 Jul 2014, 07:52 PM

Market Review for KLCI:

Malaysian stocks opened on a mixed note or can say slightly higher on getting a buying momentum with KLCI at 1870.41and closed higher today helped by the continued buying support in selected heavyweights. Most Asian stock markets were higher today as anxiety over the downing of Malaysia Airlines MH17 flight eased and investors shifted their focus to the US corporate earnings.

KLCI Day Performance | |

Open | 1870.41 |

High | 1873.70 |

Low | 1869.39 |

Close | 1871.83 |

Change(Points) | 0.470 |

% Change | 0.02% |

Volume | 2329.1M |

Rise | 468 |

Fall | 393 |

Unch | 794 |

Market may begin from 1870-1873 level anticipated to move up on eased tensions over the downing of Malaysia Airlines MH17 flight.

KLCI LEVELS | |||||

| Support 1 | Support 2 | Support 3 | Resistance 1 | Resistance 2 | Resistance 3 |

| 1860 | 1850 | 1835 | 1879 | 1896 | 1911 |

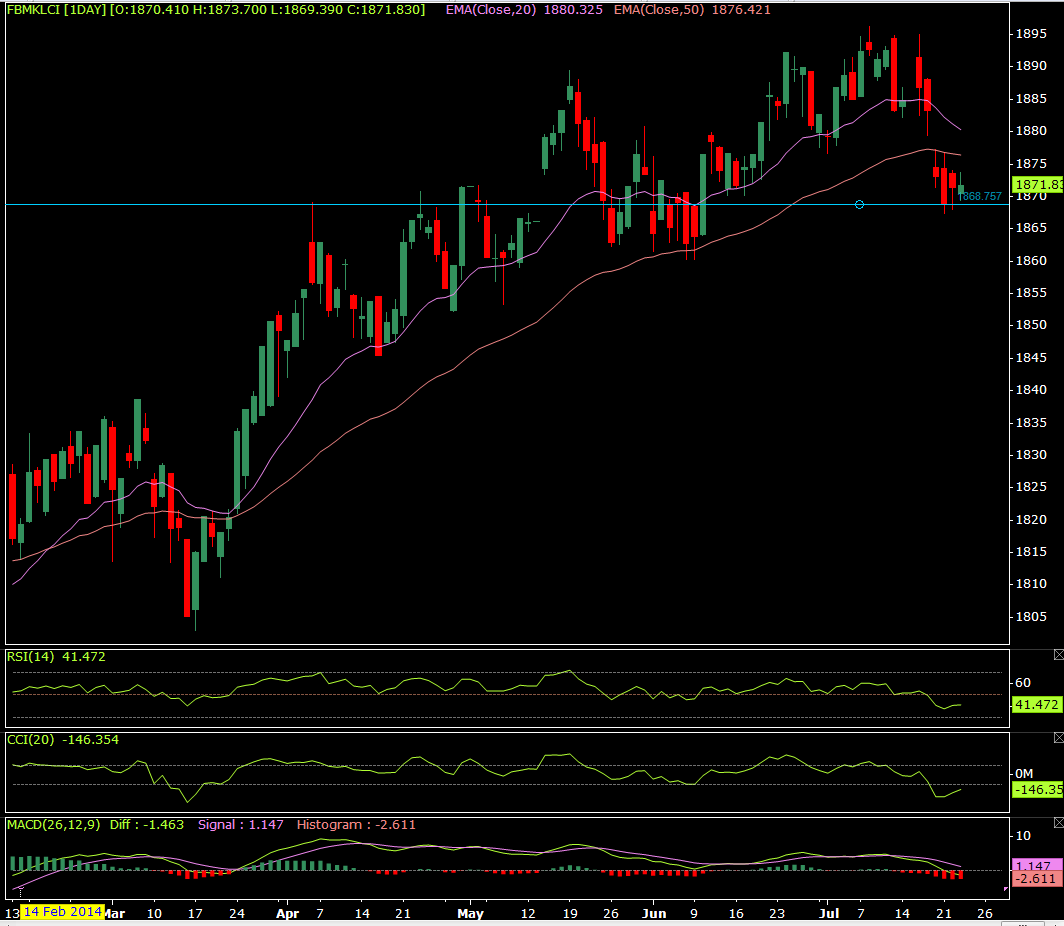

RSI stood below the centre line at 41.472 with its CCI at -146.35. Difference line of MACD performed at -1.463 below its signal line which performed at 1.147.

Top Gainers | Top Losers | ||||

| Scrip Name | CMP | %change | Scrip Name | CMP | %change |

| FGV | 4.11 | 2.49 | ASTRO | 3.29 | -2.66 |

| MISC | 6.63 | 1.69 | PPB | 14.18 | -1.53 |

| HLFG | 17.5 | 1.51 | PETDAG | 19.34 | -1.33 |

| YTL | 1.57 | 1.29 | RHBCAP | 9 | -1.1 |

| UMW | 11.62 | 0.87 | KLCC | 6.36 | -1.09 |

- The Malaysian Automotive Association (MAA) revised upwards its total industry volume (TIV) forecast for this year to 680,000 units from the earlier target of 670,000 units.

- The ringgit opened marginally higher against the US dollar quoting at 3.1735/1755 on renewed commercial demand for the domestic currency.

- The Malaysian rubber market closed marginally lowers yesterday on stronger ringgit despite the rise on the benchmark Tokyo Commodity Exchange.

- Crude palm oil (CPO) futures prices on Bursa Malaysia Derivatives closed lower yesterday on weak demand amid bearish external sentiment.

- The Malaysian Institute of Economic Research (MIER) does not expect Bank Negara Malaysia to step up borrowing costs in the immediate term.

More articles on SGX Singapore Stocks & Forex Live Picks

There's No Recession, but a Market Correction Could Cause One

Created by Your Advisor | May 10, 2017

TECH TARGETS: EUR/USD, GBP/USD, USD/JPY, AUD/USD, NZD/USD - UOB

Created by Your Advisor | Mar 23, 2017

M Asia Trade Tech Targets: EUR/USD, AUD/USD, NZD/USD, USD/JPY - UOB

Created by Your Advisor | Mar 22, 2017

Discussions

Be the first to like this. Showing 0 of 0 comments