"Where Do You See Yourself In 5, 10 or 20 Years Down The Road?"

This is a favourite question that is often posed to a candidate during an interview process.

But do you ask that about your own personal life?

Frankly, not many people have thought of it deep enough to make a serious call on a decision they make today.

Looking at the situation today, COVID-19 has inflicted incalculable social, economic, and structural damage to the country and its citizens.

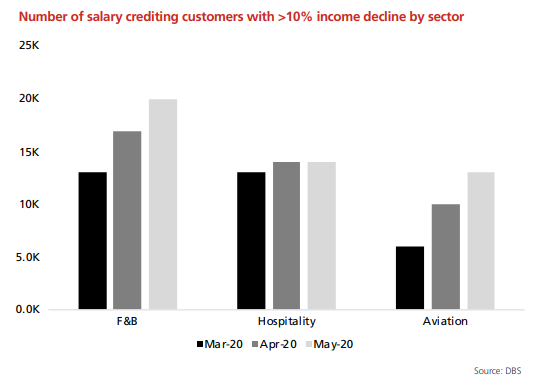

With most segments of the society struggling with the impact on the economy resulting in job losses, pay cuts, and retrenchment, COVID-19 has clearly exacerbated the situation for the lower-income group with the government requiring to step in to provide income and job support.

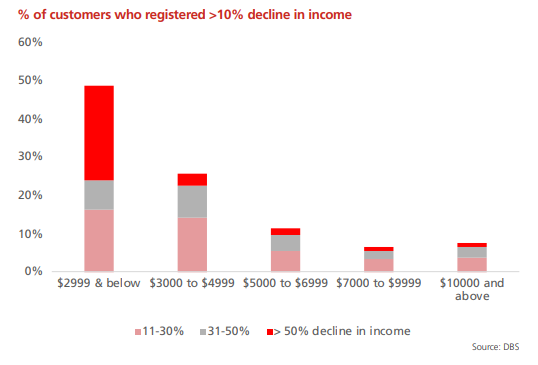

According to the study, almost half of the low-income earners (those earning $2,999 & below) experienced a drop in salary during the pandemic. Out of this population, another half of the group saw their income decline by more than 50%.

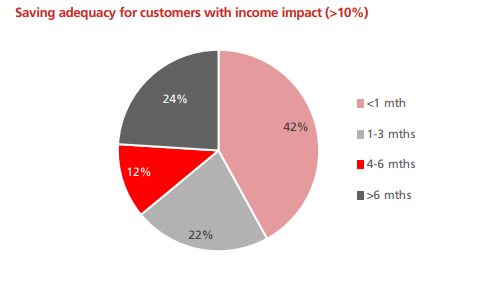

Take a look at appendix 3 appended below, for instance, 42% of the population who has experienced a decline in their income has less than one month of personal savings while another 22% has only between one to three months of cash flow to tide them through.

This is clearly well below the recommended 6 months of emergency funds that most financial planners would advise.

What lessons can we learn from COVID-19 that can enable us to make better informed financial decisions in the future? How do we impose a back-up plan to prepare ourselves sufficiently for future recessions? These are some hard yet realistic questions that we have to ask ourselves.

Thankfully, with the enhancement of digital innovation such as the NAV Planner, an individual can now project their finances simply and effectively.

|

| Appendix 1 |

|

| Appendix 2 |

|

| Appendix 3 |

Map Your Money

DBS has launched Map Your Money, a new feature in NAV Planner on DBS and POSB digibank.

This new feature allows users to have a holistic view of their overall net worth and cashflow projection through the interactive dashboard. It allows users to plan to see how much they have spent and how much income and savings are required to sustain the same kind of lifestyle, not just for months but also years ahead.

In the event of having to face an unprecedented crisis like today - which results in a likely scenario of pay cuts or retrenchment - the user can navigate the planner to see which expenses are discretionary in nature and can be cut back. The planner would also show how many months of cash flow is needed to survive comfortably.

Users may also set a few short and long term goals to look forward to.

For instance, setting aside $3,000 for a winter trip to Seoul next year can be considered a short term goal while longer-term goals can include things such as setting aside university fees for kids' education.

The CashFlow projection chart is split into 2 stages:

i.) Before Retirement - Accumulating Wealth

ii.) After Retirement - Drawing down wealth

The colored bars indicate the income stream which includes salary, rental income, dividend, CPF payout, and SRS payout. NAV Planner even takes into account all the complex CPF rules so your forecast is as accurate as possible.

The black line indicates the current expense today and the projected future spending after retirement.

The line turns red if there is a gap between the red line and the bars, indicating a shortfall that you have to bridge to get back on track.

Let's look at the 3 different scenarios below:

Scenario 1:

Let's make the following assumption under scenario 1:

- Current Age: 35

- Retirement Age: 65

- Life Expectancy: 90 Years

- Monthly Cashflow Income at age 35: $14,800 (includes salary, rental, dividend, interest)

- Monthly Cashflow Expense at age 35: $10,000 (includes home loan, groceries, transportation, and all other expenses)

- Monthly Cashflow Expense at age 65 (retirement): $3,000

Scenario 1 is a conservative figure where I decide to continue working until the retirement age of 65, where my working income will then start to taper off, and only rental and dividend income remain. The current monthly cashflow income at the current age is $14,800 which includes salary, rental, and dividends. The current monthly cashflow expense at current is at approximately $10,000 which includes the big chunk of home mortgages and kids' activities and expenses. By the time I turned 65, I am expecting the monthly expense to drop to $3,000.

Based on the Map Your Money analysis, it looks like financial freedom is on track based on the retirement schedule I've provided. I can take a huge breath of relief knowing that my financial planning is doing well.

|

| Scenario 1 |

Scenario 2:

Let's make a little tweak on the assumption under scenario 2:

- Current Age: 35

- Retirement Age: 40

- Life Expectancy: 90 Years

- Monthly Cashflow Income at age 35: $14,800 (includes salary, rental, dividend, interest)

- Monthly Cashflow Expense at age 35: $10,000 (includes home loan, groceries, transportation, and all other expenses)

- Monthly Cashflow Expense at age 40 (retirement): $3,000

Now, let's assume in scenario 2 that I would like to get a bit more adventurous by retiring earlier at the age of 40 instead of 65 years old.

I would like to retire earlier so that I can spend a bit more time with my children.

I wasn't sure though if this is a good move and if my cashflow could last till 90.

Oh well, Surprise, Surprise!!!

Based on the Map Your Money analysis, it looks like scenario 2 still fits well with my retirement plan and schedule. It means that I have the green light if I choose to do so.

|

| Scenario 2 |

Scenario 3:

Now, let's make a step more aggressive on the assumption under scenario 3:

- Current Age: 35

- Retirement Age: 40

- Life Expectancy: 90 Years

- Monthly Cashflow Income at age 35: $14,800 (includes salary, rental, dividend, interest)

- Monthly Cashflow Expense at age 35: $10,000 (includes home loan, groceries, transportation, and all other expenses)

- Monthly Cashflow Expense at age 40 (retirement): $6,000

In this scenario, I have assumed that not only do I want to retire at the age of 40, but also doubled my expense from $3,000 to $6,000 after I retire. Perhaps, I wanted to enjoy life a little bit more by staying at a 6-star hotel and travel more after I retire.

Based on the analysis, it seems like my dream looks a little distant from my current profile. It appears that my cashflow would not be able to last me until 90 years old.

Conclusion

Your goal tomorrow is the hard work and effort of what you put in today.

The "Map Your Money" function in the DBS Planner is a simple yet effective tool to help users visualize their current and future situation and make the required changes to financial planning at any point in time.

For young individuals who are working employees, the tool can help to project how much savings they need to accumulate before meeting the recommended emergency funds or before hitting important milestones such as marriage or buying their first home.

For individuals who are nearing retirement, they can utilize the tool to see if the funds can last them long enough, and if it can withstand the stress of times during an outbreak like today. For example, in the event they lost their job due to retrenchment, they also could utilize the tool to see how long their funds would last them.

What I like most about the NAV Planner is that it is flexible enough to make adjustments and changes based on our circumstances and goals in life, and it is not static. Because of this, I am able to make smarter decisions in my financial planning and enjoy the fruits of my labor in the later years to come.

To find out more about DBS NAV, click

here! Otherwise, you can go straight to planning - simply log in to your DBS/POSB digibank and

click on the 'Plan' tab.

If you need more help assembling your retirement plan, you can refer to the DBS' "DIY Manual" on retirement

here.

Disclaimer: This is a collaboration with DBS on the navigation of NAV Planner and the features it can help users to achieve greater retirement planning. I loved this feature so much that I project a lot of scenarios on my own. All scenarios projected above are based on my own pure experience using the feature.