Why Wynn Resorts (WYNN) Stock is About to Take Off: A Complete Analysis and Forecast

Collin Seow

Publish date: Wed, 05 Apr 2023, 01:16 PM

This article is for education purposes only, and not to be taken as advice to buy/sell. Please do your own due diligence before committing to any trade/investment.

A sea of green in the US stock market has brought many smiles.

This sea of green has also attracted many dormant traders and investors back into the stock market.

While this is generally good for the stock market, you need to be fully aware that stock picking isn’t as easy as it seems.

Here, I’ve discovered a gem in the gaming industry. And you’ll want to watch this stock as I think it’s about to take off.

Buckle your seatbelt and off we go!

Brief History of Wynn Resorts

Source: wynnresortsmacau.com/en/wynn-macau

Founded in 2002, Wynn Resorts made its IPO in the same year before its first property was constructed.

Wynn Resorts eventually built resorts abroad, in Macau, and operates them till this day.

Yes, the properties by Wynn Resorts are geared towards entertainment and gaming.

While it’s common knowledge that the house wins in the long run, we mustn’t assume that Wynn Resorts is strong financially.

So, let’s have a look at its business model and financials.

Business Model and Financials

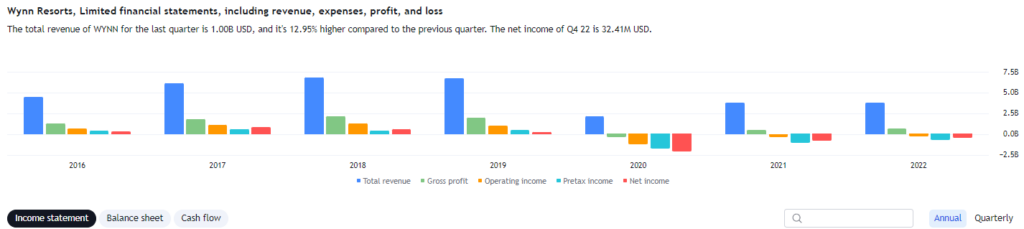

Source: tradingview.com

Shall we start off by looking at Wynn Resorts’ total revenue that’s represented by the bars in blue?

Wynn Resorts’ total revenue grew by double digits (percentage wise) in 2017 and 2018 before a small decline in 2019.

As COVID-19 struck and affected the world, Wynn Resorts wasn’t spared. Its total revenue plunged.

But it managed to recover in 2021 and 2022.

As its total revenue surged in 2017, Wynn Resorts’ net income surged too.

However this correlation didn’t continue in 2018.

From 2018, the company’s net income shrank rapidly till 2020, after which there was improvement till today.

Wynn Resorts derive its revenue from gaming, its hotel facilities, and bookings. As such, its business model is highly reliant on holiday makers.

Knowing the business model and financial health of Wynn Resorts, does its price chart shout of a buying opportunity for a position trade?

Technical Analysis on Wynn Resorts (NASDAQ: WYNN)

Can you tell that the chart of WYNN is on a strong uptrend?

This can be seen by the sheer number of blue candles (outline and solid), and number of green arrows.

Here’s the best part of this chart and trading system – you don’t need to spend half an hour figuring out where to plot your support and resistance lines, trendlines, or the location to plot your Fibonacci tools.

Yes, you can trade just with the main indicators you see in the chart above – the green arrow and the Trend Impulse Factor indicators.

Let me expand on the first indicator – the green arrow.

The green arrow appears under a candle when a new bullish move is detected. This is where you want to start paying attention to the counter because you’ll want to catch an uptrend early to enjoy possibly a larger reward.

Next, you’ll want to have a look at the bar of its Trend Impulse Factor indicator. You’ll want the bar to be in dark green which suggests sustained momentum.

Back to the chart of WYNN, do you see both indicators agreeing with each other on its latest candle?

This is significant as it means that WYNN is ripe for a position trade and could take off in no time.

Conclusion

Source: wynnresorts.com

Wynn Resorts is in the gaming and hospitality business.

While its financial health is still weak, its price chart is extremely bullish.

As position traders, the price chart of any counter holds more weight.

The 2 indicators on its chart suggest that there’s a good position trading opportunity.

Both the arrow and Trend Impulse Factor indicator have been tested and proven. They form the TradersGPS (TGPS) system to help you decipher if a stock is ripe for a position trade. You won't have to feel in the dark and make wild guesses.

If you’re struggling to make money from the market, just do this ONE thing in 2023:

If you’re like most people, you probably think that building a profitable side income stream from the stock market is something that is extremely difficult to achieve, and time-consuming as well.

And you probably know that one friend or relative who has lost a lot of hard-earned money to the market despite being ‘experienced’.

And especially since 2022 was a time when we saw many people in the red, bag-holding 20-80% losses…

It’s understandable to see why most people have such a grudge towards the idea of profiting from the market.

But what if I told you that amongst the many skills required to be profitable in trading…

There is one simple skill that will never make you feel that making money in the stock market is difficult ever again?

A skill that, if mastered, can dramatically increase your chances of success in the stock market.

I’m talking about the skill of identifying the right strong stocks.

If you have heard of this before but still do not have it figured out yet, let today be the day you get it right.

You see, the #1 problem with most ‘experienced’ traders who just can’t seem to make money consistently from the market despite having consumed tons of learning resources & materials is not because there is a problem with their strategies.

It’s because unbeknownst to them, they are constantly buying the WRONG stocks.

Stocks that have very bad set-ups, price movement, and in general just a low probability of moving in the direction you wish for.

In fact, this process of picking the right stocks is a crucial step that most people don’t even think about.

Ask yourself this, what is your current process for knowing what stocks to buy?

Companies that you like such as TSLA, META, AAPL etc..?

Stocks that your friends tell you to buy?

Stocks that you read about in financial news, blogs or Youtube videos?

Or even stocks that you spend hours reading up their financial reports and doing fundamental analysis?

If you have done any one of the above, you are making a dangerous mistake and that has to change.

Knowing how to pick strong stocks with the highest profit potential using a proper proven strategy is half the battle won.

It instantly eliminates any potential ‘bad characteristics’ of the stock and significantly increases your chances of being right in the trade.

Once you know how to pick strong, potential stocks, whatever comes after (knowing when to buy or sell) becomes a breeze and you can start expecting to see real, consistent results.

That’s how exactly I was able to still execute 20-40% and higher trades last year when the entire market was down.

So if you think profitable trading is difficult, think again.

I’ve trained thousands of students who started off with complete 0 experience and whose portfolio results are now lightyears ahead of their peers who started learning years before them.

That’s the power of mastering this very simple skill of identifying the right strong stocks.

It literally gives you the weapon to be able to profit in all sorts of market conditions, because opportunities are ALWAYS in the market. It’s all about knowing how to find them!

I hope you’ve learnt this very important lesson today, but more importantly, take action in pursuing the mastery of this skill.

I have an upcoming free LIVE training demonstrating my exact process on how I find strong stocks in less than 15 minutes using a very simple strategy.

What I will be revealing is a tested and proven counter-intuitive approach that you’ve probably never seen before, and it’s something you can apply almost immediately.

So if you’re excited to cut through the B.S and master the intricate skill of profitable trading…

Register your seats here and join me LIVE very soon!

P.S You can also get to ask me any stocks you are currently thinking of buying and I’ll show you if it’s a strong stock and whether the odds are stacked in your favour or not!

More articles on Collin Seow Remisier Blog

Created by Collin Seow | Aug 14, 2024

Created by Collin Seow | Jul 31, 2024

Created by Collin Seow | Jun 26, 2024

Created by Collin Seow | May 29, 2024

Created by Collin Seow | May 15, 2024

Created by Collin Seow | Apr 24, 2024