Does Shorting This Infrastructure Solutions Company Make Sense?

Collin Seow

Publish date: Wed, 15 Mar 2023, 05:43 PM

This article is for education purposes only, and not to be taken as advice to buy/sell. Please do your own due diligence before committing to any trade/investment.

Source: unsplash.com

What a panicky start of the week it was!

2 huge banks shuttered in a span of a couple of days: Silicon Valley Bank and Signature Bank.

All appears to be doom and gloom.

Or is it?

It’s natural to feel fearful.

And there are still trading opportunities in times of fear.

Shall we explore if it makes sense to go short on this infrastructure solutions company?

Brief History of Crown Castle

Source: crowncastle.com

Crown Castle was founded in 1994 with a portfolio of 133 cell towers, providing connectivity.

Within 4 short years, it has grown its portfolio by more than 10 times, and got listed on NASDAQ.

And continue growing, it did!

Through organic growth, leasing, and mergers and acquisitions, Crown Castle grew rapidly.

Crown Castle was able to expand in its offerings too!

While all these sound great, has Crown Castle been financially healthy?

Let’s find out.

Business Model and Financials

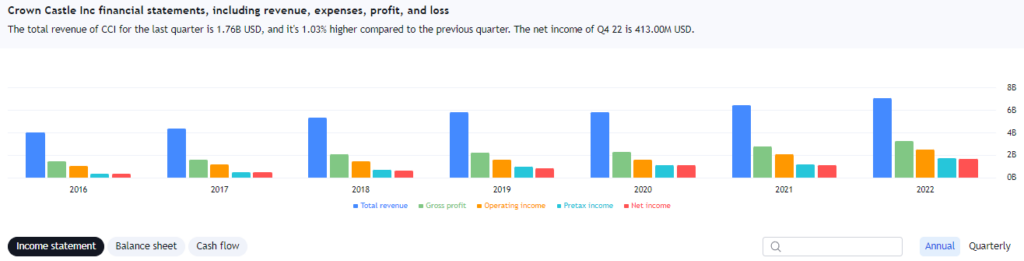

Source: tradingview.com

At a quick glance, you can tell that the total revenue of Crown Castle has been increasing every year since 2016. It has also almost doubled, with $3.9b in 2016 and $7b in 2022!

Has its net income been growing steadily too?

Yes!

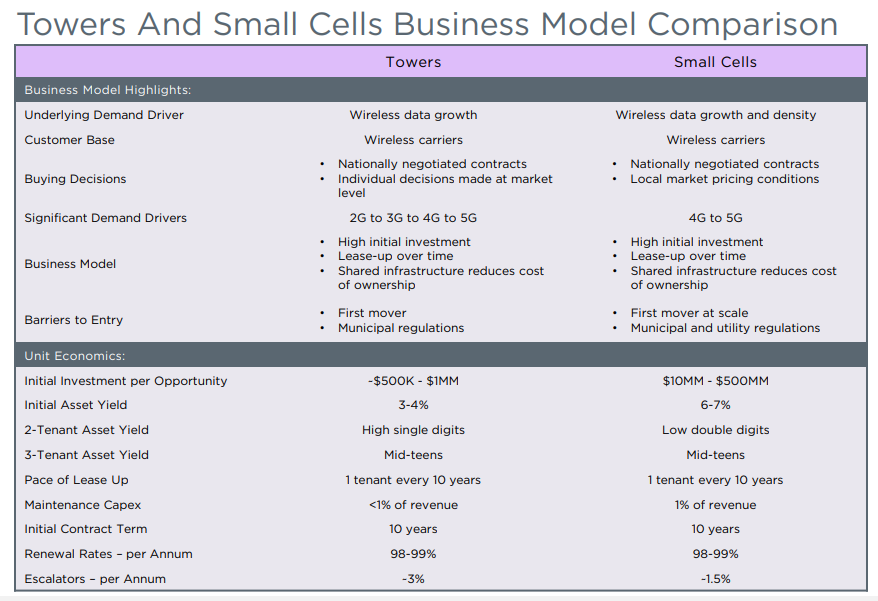

Source: crowncastle.com/investors/investor-presentation.pdf

From the image above, you can tell that Crown Castle has a stable recurring income producing business model.

That’s all good!

So is there any reason to short the stock of this company?

Technical Analysis on Crown Castle (NYSE: CCI)

Did you know that you can actually tell the action to be taken just by looking at this chart?

No technical drawings. No other indicators.

Allow me to elaborate.

The sighting of a red arrow above the latest candle of Crown Castle tells you that a new bear movement has begun. This means that you’ll want to be looking for shorting opportunities.

But before you short the share of Crown Castle, you’ll want to have a look at the Trend Impulse Factor indicator.

More specifically, you’ll want to look at the colour of the Trend Impulse Factor indicator.

Is it dark green in colour?

A bar that’s dark green in colour is what you want as that signals momentum.

Momentum is important because it’s in a sustained price move that it’s easier to profit from the market.

Here, its bar isn’t dark green in colour yet.

Hence, shorting the shares of Crown Castle doesn’t make sense yet.

Conclusion

Source: crowncastle.com/infrastructure-solutions/towers

Crown Castle can be considered a young company, under 30 years old.

With a wide network of telecommunications infrastructure, this company has grown to be a major player in the US.

Sound management and the nature of its business have strengthened the company’s financial health every year.

Yet, its share price has been falling in recent times.

A red arrow can be seen on its latest candle.

Examining further without the need of other technical tools, we concluded that the time to short its shares isn’t here yet.

Simplicity is the beauty of this trading system.

The arrow and Trend Impulse Factor indicator have been tested and proven. They form the TradersGPS (TGPS) system to help you decipher if a stock is ripe for a position trade. You won't have to feel in the dark and make wild guesses.

If you’re struggling to make money from the market, just do this ONE thing in 2023:

If you’re like most people, you probably think that building a profitable side income stream from the stock market is something that is extremely difficult to achieve, and time-consuming as well.

And you probably know that one friend or relative who has lost a lot of hard-earned money to the market despite being ‘experienced’.

And especially since 2022 was a time when we saw many people in the red, bag-holding 20-80% losses…

It’s understandable to see why most people have such a grudge towards the idea of profiting from the market.

But what if I told you that amongst the many skills required to be profitable in trading…

There is one simple skill that will never make you feel that making money in the stock market is difficult ever again?

A skill that, if mastered, can dramatically increase your chances of success in the stock market.

I’m talking about the skill of identifying the right strong stocks.

If you have heard of this before but still do not have it figured out yet, let today be the day you get it right.

You see, the #1 problem with most ‘experienced’ traders who just can’t seem to make money consistently from the market despite having consumed tons of learning resources & materials is not because there is a problem with their strategies.

It’s because unbeknownst to them, they are constantly buying the WRONG stocks.

Stocks that have very bad set-ups, price movement, and in general just a low probability of moving in the direction you wish for.

In fact, this process of picking the right stocks is a crucial step that most people don’t even think about.

Ask yourself this, what is your current process for knowing what stocks to buy?

Companies that you like such as TSLA, META, AAPL etc..?

Stocks that your friends tell you to buy?

Stocks that you read about in financial news, blogs or Youtube videos?

Or even stocks that you spend hours reading up their financial reports and doing fundamental analysis?

If you have done any one of the above, you are making a dangerous mistake and that has to change.

Knowing how to pick strong stocks with the highest profit potential using a proper proven strategy is half the battle won.

It instantly eliminates any potential ‘bad characteristics’ of the stock and significantly increases your chances of being right in the trade.

Once you know how to pick strong, potential stocks, whatever comes after (knowing when to buy or sell) becomes a breeze and you can start expecting to see real, consistent results.

That’s how exactly I was able to still execute 20-40% and higher trades last year when the entire market was down.

So if you think profitable trading is difficult, think again.

I’ve trained thousands of students who started off with complete 0 experience and whose portfolio results are now lightyears ahead of their peers who started learning years before them.

That’s the power of mastering this very simple skill of identifying the right strong stocks.

It literally gives you the weapon to be able to profit in all sorts of market conditions, because opportunities are ALWAYS in the market. It’s all about knowing how to find them!

I hope you’ve learnt this very important lesson today, but more importantly, take action in pursuing the mastery of this skill.

I have an upcoming free LIVE training demonstrating my exact process on how I find strong stocks in less than 15 minutes using a very simple strategy.

What I will be revealing is a tested and proven counter-intuitive approach that you’ve probably never seen before, and it’s something you can apply almost immediately.

So if you’re excited to cut through the B.S and master the intricate skill of profitable trading…

Register your seats here and join me LIVE very soon!

P.S You can also get to ask me any stocks you are currently thinking of buying and I’ll show you if it’s a strong stock and whether the odds are stacked in your favour or not!

More articles on Collin Seow Remisier Blog

Created by Collin Seow | Nov 27, 2024

Created by Collin Seow | Oct 30, 2024

Created by Collin Seow | Oct 02, 2024

Created by Collin Seow | Aug 14, 2024

Created by Collin Seow | Jul 31, 2024