The Boring Investor

Some Hotels Could Be Very Valuable!

When Mandarin Oriental announced that it was carrying out a strategic review for its The Excelsior hotel in Hong Kong, its share price promptly shot up from USD1.27 at the beginning of the year to USD2.81 at its peak in Sep. There was talk that the sale of The Excelsior would have added nearly USD3 to its share price. Mandarin owns a total of 17 hotels through subsidiaries, associates and joint ventures. Imagine how valuable the entire group would be if all its hotels could be valued at similar valuations.

I did not pursue Mandarin, since its share price had already shot up. However, when City Developments announced that it was privatising its hotel subsidiary, Millennium & Copthorne (M&C), I decided to take a closer look at the hotel groups listed on SGX. There could be something valuable about hotels that insiders know but the market does not know.

One of the hotel groups I looked at was Hotel Grand Central. It owns 14 hotels in Singapore, Malaysia, Australia, New Zealand and China. Grand Central revalues its properties every 3 years. The last revaluation was carried out in 2015. The current value of the freehold land on its books is $221.0M. It also disclosed that if it had used the historical cost model to record the book value of the land (i.e. no revaluation), the book value would only be $42.5M. The market value of the freehold land is actually 5.2 times the book value if there were no revaluations! Some hotels are sitting on very valuable land! It suggests that hotel groups that do not carry out regular revaluations might be worth a lot more than their book values and share prices suggest.

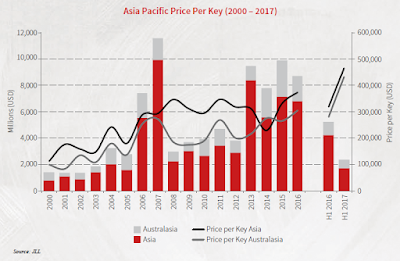

The next hotel group I studied was Stamford Land. It is a property developer focusing on the Australian and NZ markets and owns 7 hotels in Australia and NZ. Unlike Grand Central, Stamford Land does not revalue its properties. The hotels were mostly acquired between 1994 and 2000. The current book value of the hotels is $375.0M. The figure below from JLL shows how hotel sale prices in terms of price per room have risen in Asia and Australia since 2000. From 2000, the price per room in Australia has risen 3 fold from USD100,000 per room to USD300,000 per room.

Separately, I managed to search for hotel transactions in Australia which could serve as a reference for the market value of Stamford Land's hotels (see Tourism Australia website). The valuations are shown below. Note that the valuations are just for reference as there could be many factors affecting the valuations of different hotels.

|

| Fig. 1: Hotel Sale Price Per Room Since 2000 |

Separately, I managed to search for hotel transactions in Australia which could serve as a reference for the market value of Stamford Land's hotels (see Tourism Australia website). The valuations are shown below. Note that the valuations are just for reference as there could be many factors affecting the valuations of different hotels.

Based on the hotel transactions, the market value of Stamford Land's hotels could be worth about SGD611.9M. This is 63% above the book value of $375.0M. Adding the "revaluation surplus" back to Stamford Land's equity, the NAV would increase from $0.57 to $0.85.

However, before you get too excited, value stocks need a catalyst in order for the market to recognise their value. The reason why Stamford Land is undervalued is because it has not sold its hotels in the past 20 years. There is no reason to believe why it will sell them now or in the next 20 years and return the money to shareholders. For this reason, I did not buy a lot of it.

A potential catalyst worth tracking is that the CEO role has been handed over from the father to the son. In the Annual Report 2017, the new CEO mentioned about exploring the viability of setting up a REIT. This might unlock shareholder value. But do not bank on it in the immediate term.

In conclusion, hotels are boring business. But they could be very valuable!

However, before you get too excited, value stocks need a catalyst in order for the market to recognise their value. The reason why Stamford Land is undervalued is because it has not sold its hotels in the past 20 years. There is no reason to believe why it will sell them now or in the next 20 years and return the money to shareholders. For this reason, I did not buy a lot of it.

A potential catalyst worth tracking is that the CEO role has been handed over from the father to the son. In the Annual Report 2017, the new CEO mentioned about exploring the viability of setting up a REIT. This might unlock shareholder value. But do not bank on it in the immediate term.

In conclusion, hotels are boring business. But they could be very valuable!

More articles on The Boring Investor

Discussions

Be the first to like this. Showing 0 of 0 comments