The Boring Investor

SSB Interest Rate Estimates - A Year On

Some readers might know that I run a parallel blog at (The) Boring Investor's Statistics that shows some of the investment statistics that I monitor on a regular basis. One of these statistics is a forecast of the interest rates of the Singapore Savings Bonds (SSBs) to be announced in the upcoming month. The interest rates for the SSB to be announced in the following month is based on the average yield (i.e. interest rates) of the Singapore Government Securities (SGS) benchmark bonds in the current month. As an example, the SSB to be announced in Nov (and issued on 1 Dec) is based on the average SGS yields in Oct. The SSB that is available for subscription in Oct, however, is based on the average SGS yields in Sep. Thus, by comparing the average SGS yields for Sep and Oct, you can assess whether you should apply for Oct's SSB (to be issued on 1 Nov) or wait for Nov's SSB.

There is, however, a small issue. Applications for SSBs close on the 4th last business day of the month. In the case of Oct's SSB, it closed on 26 Oct. Thus, if you are thinking of whether to apply for Oct's SSB or wait for Nov's SSB on 26 Oct, you only have the SGS yields from 1 Oct to 26 Oct to compare against the yields for the entire month of Sep. If the yields from 27 Oct to 31 Oct were to change drastically from the yields from 1 Oct to 26 Oct, your forecasts for Nov's SSB interest rates would be incorrect.

For my (The) Boring Investor's Statistics blog, I usually blog on weekends only, hence, the forecast is carried out and posted even earlier, on the weekend prior to the close of application. This means that the post can sometimes be as many as 8 business days from the end of the month. The forecast error can be larger. As an example, for Oct, the application closed on 26 Oct, but my forecast was posted last Sun on 23 Oct. This means that I have 3 fewer days of data to carry out my forecast.

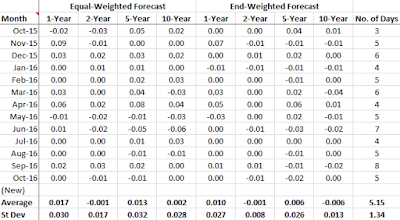

I usually provide 2 forecasts, one based on the SGS yields up to the date of forecast (known as the equal-weighted forecast), and another assuming the yields for the remaining days of the month to be the same as that on the last available date (known as the end-weighted forecast, because the yield on the last available date has a weight of 3-8 times more than all other days). After providing the forecasts for over a year, how accurate have my forecasts been? Fig. 1 below shows the forecast errors for both methods.

|

| Fig. 1: SSB Interest Rate Forecast Errors |

The figure above shows that the average errors for the end-weighted forecasts are smaller than that of the equal-weighted forecasts for all time periods except for the 10-year interest rates. However, on closer inspection, the equal-weighted forecast errors are of higher magnitude and are sometimes postive and sometimes negative, resulting in a smaller error when averaged. When compared using standard deviation, which considers only the absolute value of the errors, the end-weighted forecasts have smaller variance than the equal-weighted forecasts for all time periods. Thus, end-weighted forecasts provide better estimates of the SSB interest rates.

Fig. 2 below shows the forecast SSB interest rates superimposed on the SGS yields for the previous month. When SGS yields are relatively constant for the month, both forecasts yield very good results. However, when SGS yields are either rising or falling, the errors become larger. The equal-weighted forecasts have larger errors than the end-weighted forecasts because they do not take into consideration the direction of the SGS yields. End-weighted forecasts are more accurate as they give more weight to the SGS yields near the end of the month as described above.

|

| Fig. 2: Accuracy of SSB Interest Rate Forecasts |

Finally, the most valuable lessons that I learnt from forecasting SSB interest rates over the past 1 year is this: the future cannot be predicted. Although I could enhance my forecast methodology and perhaps provide good estimates of SSB interest rates, the best I could forecast is only 1 month in advance. I cannot forecast the SSB interest rates beyond 1 month. When the first tranche of SSB was announced in Sep 2015 with a 10-year interest rate of 2.63%, I forecasted that the next tranche of SSB would have a higher interest rate and decided not to apply for it. When the second tranche was announced with a 10-year interest rate of 2.78%, I was proven right! At that time, there was even an outcry among the SSB investors who had applied for the first tranche as their SSBs were now less valuable. Little did I expect that the SSB interest rates for all subsequent tranches would drop below that of the first tranche! The 10-year interest rate for the current tranche is only 1.79%, which is much lower than the 2.63% for the first tranche. Investors who bought into the first tranche of SSBs got a good deal after all. Smart alecs like me can only watch the SSB interest rates going lower.

If you are interested in forecasts of the SSB interest rates, you can refer to SSB Interest Rate Estimates at my (The) Boring Investor's Statistics blog. Just bear in mind the lesson I learnt above, which is that the future cannot be predicted.

See related blog posts:

More articles on The Boring Investor

Discussions

Be the first to like this. Showing 0 of 0 comments