The Boring Investor

A Comparison of the 3 Local Banks

A month ago, I mentioned that although the banks have become attractive, there is no more room for errors in my portfolio allocation. Hence, I have not picked up any bank stocks yet. In the past 2 weeks, all 3 banks have reported their earnings for 2015. How do they stack up against one another from the risk point of view? In this post, I will analyse the banks' Non-Performing Loan (NPL) ratios.

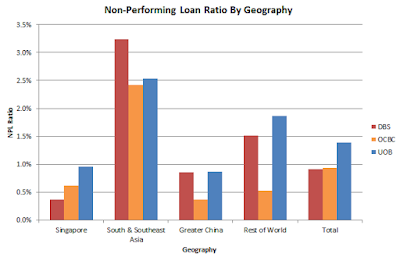

The NPL ratio is the percentage of the bank's total loans that are already or close to being in default. It eats into the bank's net interest income. As reported, both DBS and OCBC have NPL ratios of 0.9%, while UOB's NPL ratio is 1.4%. The figure below shows the NPL ratio by geography for each bank.

|

| Fig. 1: NPL Ratio by Geography |

As shown in Fig. 1, a huge contributor to the banks' NPL ratio is South and Southeast Asia, with NPL ratios between 2.4% and 3.2%. Although China is slowing down, it has not shown up in the NPL ratios for Greater China, which are between 0.4% and 0.9%. Singapore, which makes up the bulk of the banks' loans, has NPL ratios of between 0.4% and 1.0%. The proportion of the banks' loans in the various regions are shown in the figure below.

|

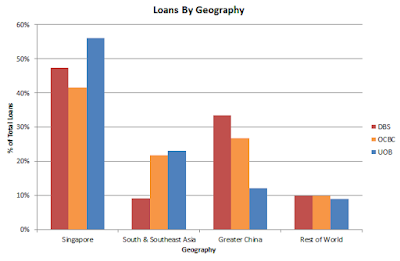

| Fig. 2: Proportion of Bank Loans in Various Regions |

As shown above, Singapore makes up the bulk of the loans of all 3 banks, with UOB having the most exposure. In South & Southeast Asia, which has the highest NPL ratio among all regions, DBS has the least exposure, as it does not have major retail presence in Malaysia and Indonesia/ Thailand. In Greater China, both DBS and OCBC have larger presence after their respective takeover of Dao Heng Bank and Wing Hang Bank in Hong Kong.

Putting the 2 figures together, South & Southeast Asia is the region to avoid currently, which DBS has the least exposure. However, the reported NPL ratios are historical figures. Moving forward, if China and/or Singapore were to slow down further, their NPL ratios would rise. In fact, if you look at Fig. 2, every bank has a safe spot. If you think South & Southeast Asia will tank further, DBS is the safest bet. If you believe China will slow down further, UOB is the safest bet. If you think Singapore will slow down further, all 3 banks will be hit, although OCBC has the least exposure among them.

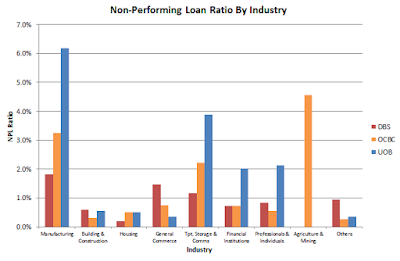

Fig. 3 below shows the NPL ratio by industry for each bank.

|

| Fig. 3: NPL Ratio by Industry |

It should be noted that the NPL-by-industry ratios for the 3 banks are not directly comparable. OCBC has an additional sector known as Agriculture, Mining & Quarrying (AMQ), which DBS and UOB do not have. That sector contains the exploration & production part of the Oil & Gas (O&G) industry, which is currently in a deep slump. I believe the O&G industry resides in the Manufacturing sector wholly for DBS & UOB and partially for OCBC. OCBC's NPL ratio for the AMQ sector is a high 4.6%. In the Manufacturing sector, the NPL ratios for DBS, OCBC and UOB are 1.8%, 3.2% and 6.2% respectively. The other sector that has NPL ratios above 1.0% for all 3 banks is Transportation, Storage & Communications (TSC). TSC contains the shipping industry, which is in a prolonged slump. Fig. 4 below shows the distribution of the banks' loans in the various industries.

|

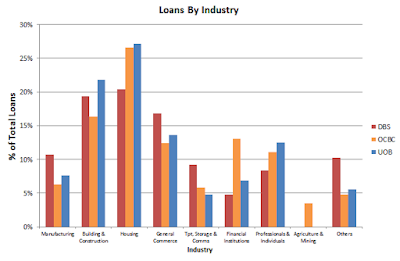

| Fig. 4: Proportion of Bank Loans in Various Industries |

As shown in Fig. 4, the bulk of the loans are in housing and Building & Construction, which are both property-related. In the 2 difficult sectors of Manufacturing (including AMQ) and TSC, DBS has the most exposure, followed by OCBC and UOB. Like the analysis by geography, every bank has a weak spot. If you think O&G and shipping will worsen further, DBS is the weakest. If you believe global banks are going to be in trouble, OCBC is the most vulnerable. If you think the local property glut will cause property prices to fall significantly, all 3 banks will be hit, with UOB having the most exposure.

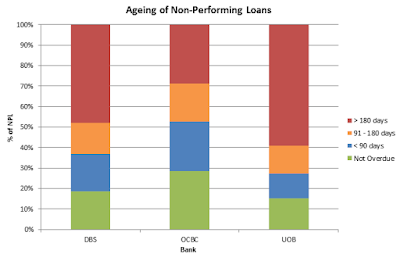

Finally, it is worth asking whether UOB's high NPL ratio is a result of them being more conservative than its 2 rivals. If it is true, it is only a matter of time that DBS' and OCBC's NPL ratio will catch up with UOB's. Fig. 5 below shows the ageing of the NPLs.

|

| Fig. 5: Ageing of Non-Performing Loans |

As shown above, the proportion of NPLs that are overdue beyond 180 days is the highest for UOB, followed by DBS and OCBC. Similarly, the proportion of NPLs that are not overdue yet is lowest for UOB, followed by DBS and OCBC. This suggests that UOB is not being overly conservative compared to the other 2 banks in classifying NPLs.

To conclude, while there are bargains in bank stocks currently, they also face uncertain times, ranging from China slowdown, O&G collapse, shipping slump, property glut, etc. Each bank has its safe and weak spots in these areas. Readers will have to figure out for themselves which bank provides the safest bet and returns.

See related blog posts:

More articles on The Boring Investor

Discussions

Be the first to like this. Showing 0 of 0 comments