Singapore Stock Exchange

Gold, Silver, Copper & Crude: Commodity Outlook 4th Oct

Alex Gray

Publish date: Fri, 04 Oct 2013, 04:53 PM

Technical Levels

| SUPPORT 1 | SUPPORT 2 | RESISTANCE 1 | RESISTANCE 2 | |

| GOLD | 1306 | 1296 | 1324 | 1340 |

| SILVER | 21.53 | 21.27 | 21.95 | 22.11 |

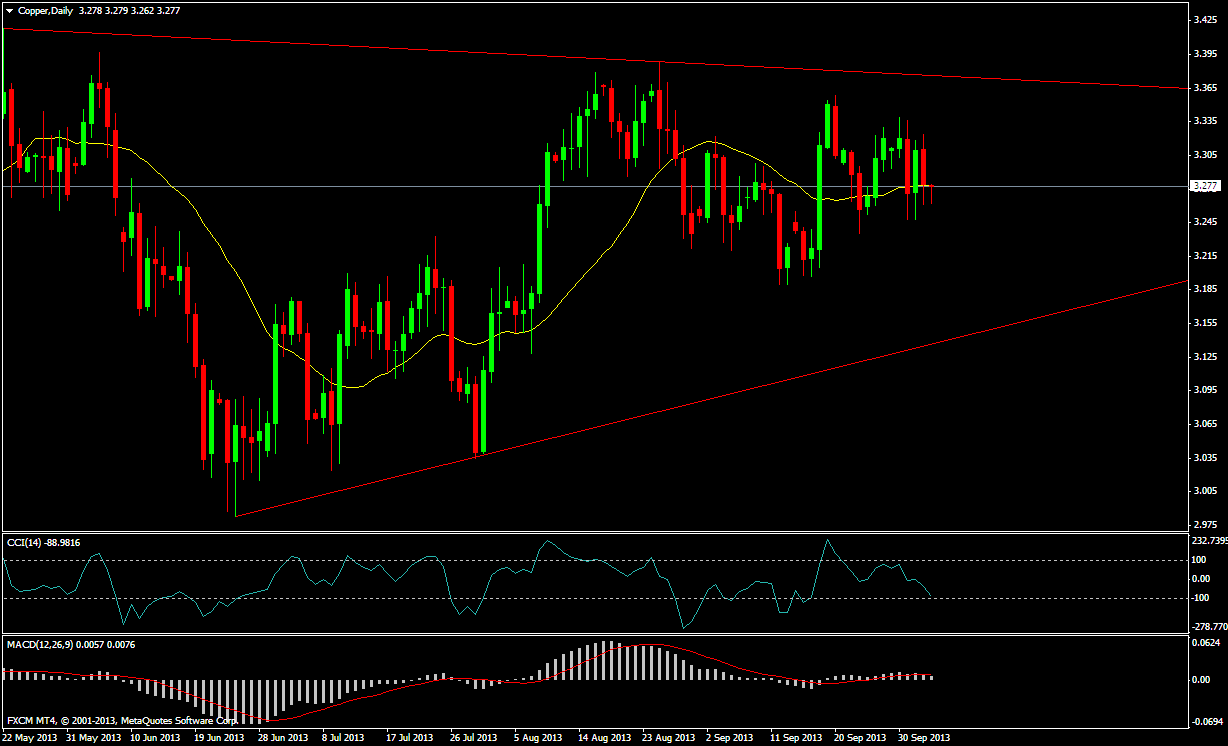

| COPPER | 3.2450 | 3.2215 | 3.3085 | 3.3485 |

| CRUDE | 102.66 | 102.01 | 104.17 | 105.03 |

Commodity Contract S2 S1 R1 R2.jpg)

.jpg)

Gold eased overnight to open today's session at 1302.50/1303.50. Price dipped slightly to a low of 1301.75/1302.75, before advancing to peak at 1322.00/1323.00 on higher than expected US continuing claims. Equities declined as the standoff in US government continued, giving a small boost to precious metals. Gold closed today at 1317.00/1318.00.

Gold closed nearly unchanged today at 1317. Key support is at the 1273 low from August 7. Resistance is at the recent high of 1354. While recent price action has not been bullish, we note that a positive reversal formed between August 7 and September 17, which generates a target of 1461. A positive reversal, in the methodology created by technician Constance Brown, is where the RSI makes a new pivot low while price makes a higher pivot low. We are watching the 1273 support area to determine if gold is trying to form a base, or if it will make a new leg lower. Gold gains after softer U.S. services sector data raised expectations that the Federal Reserve would delay any reduction in economic stimulus. A partial shutdown of U.S. federal government operations was expected to delay highly-anticipated non-farm payrolls report for September. SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, said its holdings fell 0.20 percent, or 1.8 tonnes, to 899.99 tonnes.

Gold closed nearly unchanged today at 1317. Key support is at the 1273 low from August 7. Resistance is at the recent high of 1354. While recent price action has not been bullish, we note that a positive reversal formed between August 7 and September 17, which generates a target of 1461. A positive reversal, in the methodology created by technician Constance Brown, is where the RSI makes a new pivot low while price makes a higher pivot low. We are watching the 1273 support area to determine if gold is trying to form a base, or if it will make a new leg lower. Gold gains after softer U.S. services sector data raised expectations that the Federal Reserve would delay any reduction in economic stimulus. A partial shutdown of U.S. federal government operations was expected to delay highly-anticipated non-farm payrolls report for September. SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, said its holdings fell 0.20 percent, or 1.8 tonnes, to 899.99 tonnes.Silver traded mostly flat on the day. The metal opened at 21.46/21.51, touched a low of 21.41/21.46, before moving to a high of 21.80/21.85 by midday as USD weakened. Price traded around this level for the remainder of the session, closing at 21.72/21.77.

Silver closed slightly lower today at 21.72. Interim support is at the October low of 20.62. There is also a daily uptrend in place at 20.53. While technicals have certainly not been bullish, it will be constructive if silver can hold this uptrend line. There is resistance in the low-22 area which has been a congestion area since mid-September, and which was previously a big support level from April to June. The gold-silver ratio is trading higher today at 60.82; however is still vulnerable to further losses. The downside target is 58.70, the last major low (from September 19). Resistance is at the recent high at 62.37.

Silver closed slightly lower today at 21.72. Interim support is at the October low of 20.62. There is also a daily uptrend in place at 20.53. While technicals have certainly not been bullish, it will be constructive if silver can hold this uptrend line. There is resistance in the low-22 area which has been a congestion area since mid-September, and which was previously a big support level from April to June. The gold-silver ratio is trading higher today at 60.82; however is still vulnerable to further losses. The downside target is 58.70, the last major low (from September 19). Resistance is at the recent high at 62.37.Silver got support by a weaker U.S. dollar, as the shutdown continued into a second day with no end in sight. Investors continued to weigh the implications of a protracted U.S. government shutdown. Markets were also considering how the political deadlock in Washington will impact negotiations to raise the U.S. debt ceiling.

On the Comex division of the New YorkMercantile Exchange, copper futures for December delivery traded at USD3.310 a pound during European morning trade, down 0.15%. Copper prices traded in a range between USD3.307 a pound, the daily low and a session high of USD3.325 a pound. The December contract settled 1.3% higher at USD3.316 a pound on Wednesday.

Copper prices were likely to find support at USD3.249 a pound, Wednesday's low and resistance at USD3.339 a pound, the high from September 30. Copper futures swung between small gains and losses on Thursday, as investors weighed upbeat data on non-manufacturing activity in China while continuing to monitor political wrangling in Washington. Copper dropped as weaker U.S. economic data and the continued government shutdown weighed on the outlook for industrial metal demand. ISM said its services index fell to 54.4 last month after nearing an eight-year high in August. Failure to increase the debt limit could push the world's biggest economy into default and shake markets.

Copper prices were likely to find support at USD3.249 a pound, Wednesday's low and resistance at USD3.339 a pound, the high from September 30. Copper futures swung between small gains and losses on Thursday, as investors weighed upbeat data on non-manufacturing activity in China while continuing to monitor political wrangling in Washington. Copper dropped as weaker U.S. economic data and the continued government shutdown weighed on the outlook for industrial metal demand. ISM said its services index fell to 54.4 last month after nearing an eight-year high in August. Failure to increase the debt limit could push the world's biggest economy into default and shake markets.On the New York Mercantile Exchange, light, sweet crude futures for November delivery fell 0.15% to USD103.15 per barrel in Asian trading Friday. The November contract settled lower by 0.76% at USD103.31 per barrel on Thursday. The U.S. government shutdown has carried on for the third day in a row, as House Republicans are still unable to strike a deal on spending cuts with the Senate Democrats.

A shooting near Capitol Hill, which was later on considered an isolated incident, also kept risk-taking in check. In U.S. economic news out Thursday, the ISM non-manfacturing PMI showed a sharper than expected decline from 58.6 to 54.4, lower than the consensus at 57.4. Oil futures traded lower during Friday's Asian session amid a batch of disappointing economic data and an ongoing government shutdown that threatens to imperil the world's largest economy. Crude rose after energy company TransCanada said that it would complete work on the southern leg of its Keystone Pipeline later this month. Crude inventories in the United States rose sharply last week as refinery utilisation fell, while the drawdown at Cushing slowed. A tropical storm headed for the U.S. Gulf Coast had forced producers to shut in some oil and gas production.

A shooting near Capitol Hill, which was later on considered an isolated incident, also kept risk-taking in check. In U.S. economic news out Thursday, the ISM non-manfacturing PMI showed a sharper than expected decline from 58.6 to 54.4, lower than the consensus at 57.4. Oil futures traded lower during Friday's Asian session amid a batch of disappointing economic data and an ongoing government shutdown that threatens to imperil the world's largest economy. Crude rose after energy company TransCanada said that it would complete work on the southern leg of its Keystone Pipeline later this month. Crude inventories in the United States rose sharply last week as refinery utilisation fell, while the drawdown at Cushing slowed. A tropical storm headed for the U.S. Gulf Coast had forced producers to shut in some oil and gas production.Global Economic Data

| Time | Data | Impact |

| 6.45P.M | FOMC Member Dudley Speaks | MEDIUM |

| 7.00P.M | FOMC Member Stein Speaks | MEDIUM |

FOMC Member Dudley Speaks

| Description | Due to deliver introductory remarks at the Workshop on "Fire Sales" as a Driver of Systemic Risk in Tri-Party Repo and Other Secured Funding Markets, in New York; |

| Source | Federal Reserve Bank of New York (latest release) |

| Speaker | Federal Reserve Bank of New York President William Dudley; |

| Usual Effect | More hawkish than expected = Good for currency; |

| FF Notes | FOMC voting member Jan 2009 - Jan 2020; |

| Why Traders Care | Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy; |

| Acro Expand | Federal Open Market Committee (FOMC); |

| Description | Due to deliver introductory remarks at the Workshop on "Fire Sales" as a Driver of Systemic Risk in Tri-Party Repo and Other Secured Funding Markets, in New York; |

| Source | Federal Reserve Bank of New York (latest release) |

FOMC Member Stein Speaks

| Description | Due to deliver a speech titled "The Problem of Fire Sales" at the Workshop on "Fire Sales" as a Driver of Systemic Risk in Tri-Party Repo and Other Secured Funding Markets, in New York; |

| Source | Federal Reserve (latest release) |

| Speaker | Federal Reserve Governor Jeremy Stein; |

| Usual Effect | More hawkish than expected = Good for currency; |

| FF Notes | FOMC voting member May 2012 - Jan 2018; |

| Why Traders Care | Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy; |

| Acro Expand | Federal Open Market Committee (FOMC); |

More articles on Singapore Stock Exchange

Discussions

Be the first to like this. Showing 0 of 0 comments