Singapore Stock Exchange

GOLD, SILVER, COPPER, CRUDE: Commodity Outlook 27 Sept

Alex Gray

Publish date: Fri, 27 Sep 2013, 07:03 PM

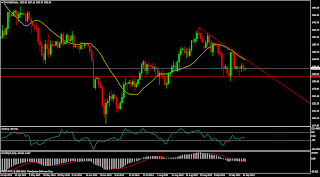

GOLD

Precious metals gave back yesterday's gains. Gold opened at 1335.50/1336.50 and traded to a session high of 1336.75/1337.75 early on. Price then dropped on better than expected US Jobless claims. The metal continued its slide after Federal Reserve Governor Jeremy Stein indicated tapering is still on the table. Gold sank to a low of 1318.50/1319.50 just after noon, and closed the day at 1323.50/1324.50.

Gold is closing today at 1324. The metal has not been able to sustain much of a bounce since last weeks sell-off from 1374, We see support at 1307 followed by 1292. The overall price formation from the last 3 months appears to have built itself into a head and shoulder formation. The neckline comes in at 1295, with a break opening a move back towards 1182 (not favored at the moment).

Gold is closing today at 1324. The metal has not been able to sustain much of a bounce since last weeks sell-off from 1374, We see support at 1307 followed by 1292. The overall price formation from the last 3 months appears to have built itself into a head and shoulder formation. The neckline comes in at 1295, with a break opening a move back towards 1182 (not favored at the moment). Gold fell as the dollar firmed after weekly jobless claims data showed an improving U.S. labour market.

U.S. jobless claims fell to a near six-year low last week, official data showed.

Uncertainty over the timing of the move has led to choppy trading over the past few sessions.

Technical Levels

SUPPORT 1 : 1315

SUPPORT 2 : 1308

RESISTANCE 1 : 1335

RESISTANCE 2 : 1347

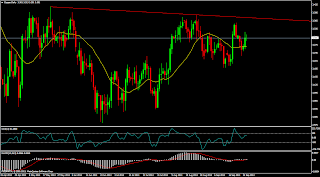

SILVER

Silver traded higher overnight before opening today at the session high of 21.99/22.04. Price then followed gold lower on positive economic data and comments by the Fed Governor. Silver consolidated to a low of 21.63/21.68, before closing at 21.72/21.77.

Silver is weaker at 21.73. Silver has not been able to sustain any bounce above 22.00 since last weeks fall from 23.39. Price action looks soft with support at 21.23.A break would yield 61.8% Fibo level 20.87. Only a close back above 22.48 will get the market talking about 25.09. The Gold Silver ratio continues to stick near 61.00 which is the 38.2% correction of our 67.41 to 57.12 August drop. We like the idea of selling the ratio around current levels but price action has not confirmed our bearish outlook.

Silver is weaker at 21.73. Silver has not been able to sustain any bounce above 22.00 since last weeks fall from 23.39. Price action looks soft with support at 21.23.A break would yield 61.8% Fibo level 20.87. Only a close back above 22.48 will get the market talking about 25.09. The Gold Silver ratio continues to stick near 61.00 which is the 38.2% correction of our 67.41 to 57.12 August drop. We like the idea of selling the ratio around current levels but price action has not confirmed our bearish outlook. Silver ended lower as pressure seen due to some encouraging US economic data.

The non-farm payrolls report next week remain the next focus for the market.

Chinese markets will be closed next week for the National Day holiday, keeping prospective buyers on the sidelines.

Technical Levels

SUPPORT 1 : 21.49

SUPPORT 2 : 21.39

RESISTANCE 1 : 21.71

RESISTANCE 2 : 21.93

COPPER

On the Comex division of the New York Mercantile Exchange, copper futures for December delivery traded at USD3.294 a pound during European morning trade, 0.39% higher.

Copper settled up by 0.39% at 458.30 gained after a report showed that the economy of the world's second biggest consumer of the commodity, US, accelerated at a faster rate than forecast. Also support seen after the update from leading copper producer Codelco will seek a significant rise in 2014 copper premiums due mostly to renewed strong demand from top buyer China, but the jump will be lower than many have predicted, a source close to the Chilean miner told.

Copper settled up by 0.39% at 458.30 gained after a report showed that the economy of the world's second biggest consumer of the commodity, US, accelerated at a faster rate than forecast. Also support seen after the update from leading copper producer Codelco will seek a significant rise in 2014 copper premiums due mostly to renewed strong demand from top buyer China, but the jump will be lower than many have predicted, a source close to the Chilean miner told. LME copper may give back some gains before the release of China's official manufacturing PMI and US non-farm employment and since Chinese investors will pull out of the market for the Chinese National Day holiday. Technically market is getting support at 455.3 and below same could see a test of 452.2 level, And resistance is now likely to be seen at 461.4, a move above could see prices testing 464.4.

The final US Q2 GDP was revised up to 2.5% from preliminary reading of 1.7% and initial jobless claims in the US were 305,000 August marks the third straight month that US existing home sales dropped, with the decline exceeding market expectations.

Technical Levels

SUPPORT 1 : 3.2976

SUPPORT 2 : 3.2913

RESISTANCE 1 : 3.3156

RESISTANCE 2 : 3.3263

CRUDE

On the New York Mercantile Exchange, light, sweet crude futures for November delivery fell 0.35% to USD102.67 per barrel in Asian trading Friday. The November contract settled higher by 0.36% at USD103.03 per barrel on Thursday.

Oil rose Thursday despite increasing tensions regarding a U.S. budget battle. Congressional Republicans and Democrats worked to craft a budget proposal to avoid an October partial government shutdown.

Oil rose Thursday despite increasing tensions regarding a U.S. budget battle. Congressional Republicans and Democrats worked to craft a budget proposal to avoid an October partial government shutdown. In U.S. economic news out Thursday, the Commerce Department's third estimate of second-quarter U.S. GDP growth was 2.5%, matching the second estimate released last month. Consumer spending rose 1.8% in the second quarter after increasing 2.3% in the first quarter.

The National Association of Realtors said pending home sales dropped 1.6% last month after a downwardly revised 1.4% drop in July. Economists expected a 1% August decline. Purchases rose 2.9% on a year-over-year basis.

Crude oil dropped due to easing political worries and an improving supply picture

Supply was recovering from Libya, and bigger U.S. stockpiles were putting pressure on prices.

Syria is not a major oil producer but prices had climbed in the past on worries that any escalation of Middle East violence could disrupt oil flows.

Technical Levels

SUPPORT 1 : 102.18

SUPPORT 2 : 101.20

RESISTANCE 1 : 103.50

RESISTANCE 2 : 103.93

Global Economic Data

| TIME | DATA | PRV | EXP | IMPACT |

| 3.15P.M | FOMC Member Evans Speaks | STRONG | ||

| 6.00P.M | Core PCE Price Index m/m | 0.10% | 0.10% | MEDIUM |

| 6.00P.M | Personal Spending m/m | 0.10% | 0.30% | MEDIUM |

| 7.25P.M | Revised UoM Consumer Sentiment | 76.8 | 78.2 | MEDIUM |

| 8.15P.M | FOMC Member Evans Speaks | 0 | 0 | MEDIUM |

FOMC Member Evans Speaks

| Description | Due to speak about current economic conditions and monetary policy at the Norges Bank Conference, in Oslo. Audience questions expected; |

| Source | Federal Reserve Bank of Chicago (latest release) |

| Speaker | Federal Reserve Bank of Chicago President Charles Evans; |

| Usual Effect | More hawkish than expected = Good for currency; |

| Next Release | Sep 27, 2013 |

| FF Notes | FOMC voting member Sep 2007 - Dec 2007, 2009, 2011 and 2013; |

| Why Traders Care | Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy; |

| Acro Expand | Federal Open Market Committee (FOMC); |

Core PCE Price Index m/m

| Source | Bureau of Economic Analysis (latest release) |

| Measures | Change in the price of goods and services purchased by consumers, excluding food and energy; |

| Usual Effect | Actual > Forecast = Good for currency; |

| Frequency | Released monthly, about 30 days after the month ends; |

| Next Release | Oct 31, 2013 |

| FF Notes | Differs from Core CPI in that it only measures goods and services targeted towards and consumed by individuals. Prices are weighted according to total expenditure per item which gives important insights into consumer spending behavior. This is rumored to be the Federal Reserve's favorite inflation measure, but CPI is released about 15 days earlier and tends to garner most of the attention; |

| Acro Expand | Personal Consumption Expenditures (PCE), Consumer Price Index (CPI); |

Revised UoM Consumer Sentiment

| Source | University of Michigan (latest release) |

| Measures | Level of a composite index based on surveyed consumers; |

| Usual Effect | Actual > Forecast = Good for currency; |

| Frequency | Released monthly, usually on the last Friday of the current month; |

| Next Release | Oct 25, 2013 |

| FF Notes | The 'Previous' listed is the 'Actual' from the Preliminary release and therefore the 'History' data will appear unconnected. There are 2 versions of this data released about 15 days apart - Preliminary and Revised. The Preliminary release is the earliest and thus tends to have more impact; |

| Derived Via | Survey of about 500 consumers which asks respondents to rate the relative level of current and future economic conditions; |

| Also Called | Reuters/University of Michigan Consumer Sentiment; |

| Acro Expand | University of Michigan (UoM); |

odity Contract S3 S2 S1R1 R2 R3