Singapore Banking Monthly – NIM Stagnates, Fee Income Recovers

traderhub8

Publish date: Mon, 11 Mar 2024, 11:21 AM

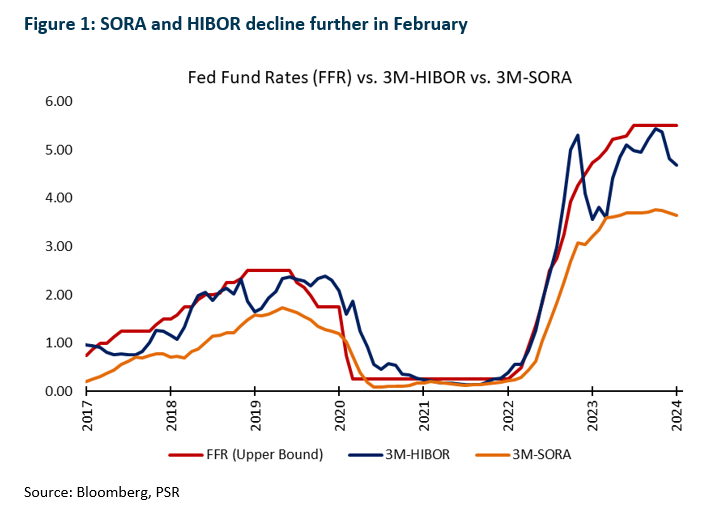

- February’s 3M-SORA was down 5bps MoM to 3.64% and was 10bps lower than the 4Q23 average. The MoM decline is similar to that in January. 3M-HIBOR was down 14bps MoM to 4.68%, smaller than the decline of 55bps in January.

- 4Q23 bank earnings were slightly above expectations. PATMI rose 7% YoY, supported by fee income growth of 21% YoY, while NII growth moderated to ~1%. FY24e guidance is for NII to remain stable YoY as NIMs dip by a few bps and stabilise at around 2-2.25% and loans growth at low-single digit. Fee income is expected to sustain earnings with expectation of double-digit growth in FY24e.

- Singapore domestic loans dipped 1.6% YoY in January, below our estimates. The loan decline was the smallest decline recorded since December 2022. The CASA balance dipped slightly to 18.1% (Dec23: 18.5%).

- Maintain OVERWEIGHT. The banks had a mixed February performance. The best performer was DBS, with a 4.7% increase, with UOB the worst, at a 1.4% decline. We remain positive on banks. NIMs may see flat growth despite the higher-for-longer interest rate environment, but a recovery in loan growth and fee income will uplift profits. Bank dividend yields are also attractive, with upside surprises due to excess capital ratios and a push towards higher ROEs.

3M-SORA and 3M-HIBOR decline continues in February

Singapore interest rates dipped in February, declining like that in January. The 3M-SORA was down 5bps MoM to 3.64%. Nonetheless, February’s 3M-SORA rose by 43bps YoY but was 10bps lower than the 4Q23 3M-SORA average of 3.74% (3Q23: 3.69%).

Hong Kong interest rates declined in February. The 3M-HIBOR was down 14bps MoM to 4.68%, smaller than the decline of 55bps in January. Nonetheless, February’s 3M-HIBOR improved by 112bps YoY but was 66bps lower than 4Q23 3M-HIBOR average of 5.34% (Figure 1).

4Q23 RESULTS HIGHLIGHTS

- NII growth declines as NIM stagnates

DBS’ 4Q23 adjusted earnings of S$2.39bn were slightly above our estimates, and FY23 adjusted PATMI was 102% of our FY23e forecast. 4Q23 DPS is raised 29% YoY to 54 cents with an additional 1-for-10 bonus issue, dividend payout ratio was higher at 48.5% in FY23 (FY22: 47.7% excluding special dividends). NII rose 5% YoY to S$3.4bn due to an 8bps YoY NIM increase to 2.13% (3Q23: 2.19%) as interest rates continue to remain high despite loan growth remaining flat YoY. DBS has provided FY24e guidance of NII to remain at the same levels as FY23, with NIMs to be maintained at FY23 exit NIM level with a possibility of a few bps drop. NII will be supported by the full-year impact of the Citi Taiwan consolidation and some trade-off between NIMs and loan growth, with the guidance of low-single-digit loan growth for FY24e. FY24e PATMI to be maintained at around the current levels in FY23.

OCBC’s 4Q23 earnings of S$1.62bn met our estimates. It came from higher fee income and stable NII. FY23 PATMI was 100% of our FY23e forecast. 4Q23 DPS was up 5% YoY to 42 cents. FY23 dividend rose 21% YoY to 82 cents, with the dividend payout ratio stable at 53%. NII growth was led by a 4% increase in average assets, which was offset by NIM moderating by 2bps YoY to 2.29% and stable loan growth. NIM moderation was mainly from higher funding costs, which offset the increase in asset yields. OCBC has provided FY24e guidance for NIM to be in the range of 2.20% to 2.25%, with FY23 exit NIM currently at 2.26% and loan growth of low-single-digit for FY24e.

UOB’s 4Q23 adjusted earnings of S$1.50bn were slightly above our estimates, and FY23 adjusted PATMI was 102% of our FY23e forecast. 4Q23 DPS was up 13% YoY to 85 cents; the full-year FY23 dividend rose 26% YoY to 170 cents, with the dividend payout ratio stable at 50%. NII dipped 6% YoY from NIM, falling 20bps YoY and 7bps QoQ to 2.02%, mainly from loan margin compression due to competition for high-quality credits and loans remaining flat YoY. UOB has guided loan growth to a low single digit and NIM of around 2% for FY24e. UOB expects to see demand for loans pick back up with rate cuts expected in 2H24 and is guiding for loans to grow 1-3% in Singapore and 4-5% in the region. However, we expect a slowdown in the first few quarters of FY24 as rates remain high, with the recovery expected in 2H24.

- Fee income continues to recover strongly

DBS’ 4Q23 fee income rose 31% YoY to S$867mn. WM fees increased 41% YoY, driven by strong net new money inflows as customers shifted deposits into bancassurance and investments. In comparison, card fees grew 27% YoY from higher spending and the integration of Citi Taiwan. Loan-related fees rose 80% YoY, and investment banking fees rose 26% YoY, offset by a 4% YoY decline in transaction fees as trade finance slowed. DBS is guiding for double-digit fee income growth for FY24e, which will be sustained by wealth management and credit card fees.

OCBC’s 4Q23 fee income rose 15% YoY to S$460mn. This was due to the broad-based growth in wealth management fees from increased customer activities, higher credit card fees, and loan and trade-related fees. Furthermore, the Group’s FY23 wealth management income grew 26% YoY to S$4.3bn and contributed 32% to the Group’s total income FY23 (FY22: 30%). OCBC’s recent acquisitions of PT Bank Commonwealth in Indonesia will accelerate its growth in ASEAN. Therefore, we are expecting fee income growth of 12% for FY24e.

UOB’s 4Q23 fees grew 17% YoY, largely due to higher credit card fees, which hit a new record of S$125mn (+69% YoY), boosted by higher card spending on an enlarged regional franchise due to the Citi integration. Wealth management fees recovered modestly by 21% YoY, while loan-related fees grew 5% YoY amid cautious investor sentiment. UOB has successfully integrated their Citi portfolios in Malaysia and Indonesia, with Thailand and Vietnam to be completed by FY24, which could further expand their regional franchise. As such, they have guided for double-digit fee income growth in FY24e, which could add ~S$220mn to revenue.

Source: Phillip Capital Research - 11 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | May 20, 2024

Created by traderhub8 | May 15, 2024

Created by traderhub8 | May 14, 2024