Venture Corporation Ltd – Recovery Back-loaded

traderhub8

Publish date: Mon, 26 Feb 2024, 11:15 AM

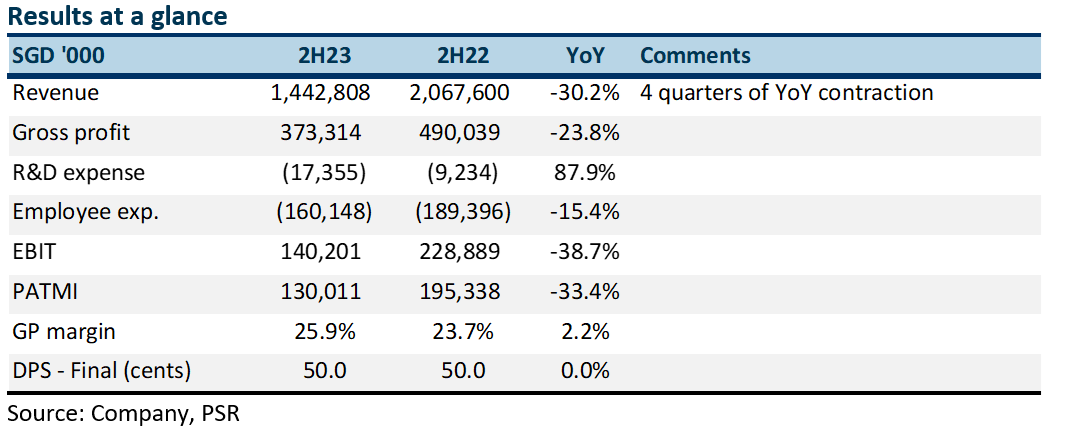

- 2023 results were within expectations. Both revenue and PATMI were 99% of our FY23 forecast. Earnings weakness persisted into the 4Q23, with PAT declining 25% YoY to S$67.4mn. The final dividend was unchanged at 50 cents and full-year at 75 cents.

- The outlook provided by the company, we believe, is for revenue softness to persist into 1H24 before recovery in the later part of the year. We believe driving growth will be new products by customers in semiconductor equipment, data centres connections, and medical and luxury consumer products.

- We nudge our FY24e earnings to be 2% higher and maintain our NEUTRAL recommendation. Our target price is raised modestly to S$12.75 (prev. S$12.50), based on a 2 year historical PE ratio of 13x. The dividend yield of 5.5% is reasonable, and the balance sheet is healthy, with record cash holdings of S$1bn. Visibility to earnings growth is poor and depends on customer confidence to launch new products.

The Positive

+ Record net cash. Free cash flow generated was a record S$478mn (FY23: S$236mn). The large jump in operating cash was from the decline in inventories of S$220mn. Net cash on the balance sheet surged to record S$1.05bn. Inventory is beginning to normalise to S$822mn but remains higher than pre-pandemic levels of S$706mn, despite the lower revenue. Interest income has almost tripled to S$28mn, accounting for 8% of earnings.

The Negative

– Sluggish revenue and earnings. The net profit for Venture is at a seven-year low. An inability to capture higher growth products plus delays in new product introductions and laclustre ramp-up in volumes have been major reasons for the multi-year decline in earnings.

Outlook

The company’s outlook is for 2H24 to be stronger than 1H24. This is not new and has been the typical seasonality for Venture. We believe it implies softer revenues in the near term and a possible ramp-up later in the year. Visibility is poor as it depends on customer confidence and the ability to launch new products. Growth segments for Venture will include semiconductor equipment, data centres connections, and medical and luxury consumer products.

Maintain NEUTRAL with a higher TP of S$12.75 (prev. S$12.50)

Our FY24e earnings are raised a marginal by 2% to S$287mn.

Source: Phillip Capital Research - 26 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Trader Hub

Created by traderhub8 | May 20, 2024

Created by traderhub8 | May 15, 2024

Created by traderhub8 | May 14, 2024