Singapore Airlines – Rising Pressure on Load Factors and Yields

traderhub8

Publish date: Thu, 22 Jun 2023, 10:51 AM

- After an exceptional year in FY23 driven by early-mover advantage, we expect SIA’s net profit in FY24e and FY25e to decline by 24% and 46%, respectively, with tapering passenger yields and passenger load factors.

- We expect net cash outflow in FY24e as it spends on aircraft fleet renewal, redeems 50% of the remaining mandatory convertible bonds, and invests in the merger of Vistara and Air India. We expect FY24e dividends to be cut.

- Air cargo demand may fall in the next two years with slower global trade and manufacturing output and competition from lower-cost sea freight. Industry cargo capacity is back to pre-pandemic levels.

- We resume coverage with a REDUCE recommendation and TP of S$6.80, based on 1.1x price to book for FY24e. This is in line with historical P/B of 1.1x.

Highlights

- FY23 was an exceptional year for SIA. The airline enjoyed an early-mover advantage in restoring capacity amid border re-opening. Group passenger capacity reached 79% of pre-Covid levels in March 2023, higher than the 58% for peers. Passenger load factor hit 85.4%, the highest in SIA’s history. We expect net profit in FY24e and FY25e to decline by 24% and 46%, respectively, with tapering passenger yields and passenger load factors. Other Asian airlines have only began to resume passenger capacity. As these airlines build up their capacity, SIA’s margins could normalize. This reflects competition in airfares, crew, and staff. One positive is a 30% YoY decline in jet fuel prices.

- Expect net cash outflow in FY24e. SIA will have to spend S$3.35bn on the partial redemption of its second tranche of mandatory convertible bonds in Jun 2023. It will also have to spend on aircraft fleet renewal and expansion and invest S$360mn in the Vistara/Air India merged group.

- Air cargo demand may fall in the next two years. With more airlines resuming passenger flights, belly-hold capacity has lifted industry cargo capacity back to pre-pandemic levels, in April 2023. On the other hand, cargo loads contracted by 10.1% YoY in the first four months of 2023, according to IATA. This was due to: 1) slower growth in global trade and manufacturing output; and 2) customers’ preference for sea freight over air freight. As air cargo yields are still 45% higher than 2019 levels while container yields have declined to about 8% of 2019 levels, containers are now a more attractive transportation option.

- Potential merger of Vistara and Air India will yield a book gain of S$1.1bn. The proposed merger of 49%-owned TATA SIA Airlines Ltd (Vistara) will lead to a non-cash accounting gain of S$1.1bn for SIA, as it writes back its investment in Vistara. The enlarged entity will have a dominant share of 23% each of domestic and international passenger traffic in India. However, on a pro-forma basis, it is still in net loss of S$1.02bn in 1HFY22/23. With a 25.1% stake, SIA would recognize its share of profit or loss.

Resume coverage with a Reduce recommendation and TP of S$6.80.

Our TP is based on 1.1x FY24e book value per share. We expect SIA to deliver sustainable ROE of 8%, from which we derived a target price to book of 1.1x at COE of 7.0%.

Background

Singapore Airlines (SIA) provides global air transportation services for passenger and cargo. The full-service passenger service and cargo service are operated under “Singapore Airlines” brand, while “Scoot” is the low-cost carriers that offer no-frills services to short-haul and regional routes. As of 31 March 2023, the group’s passenger network covered 109 destinations in 36 countries and territories. SIA served 74 destinations while Scoot served 58 destinations. The cargo network comprised 118 destinations in 38 countries and territories. Through code-sharing with other airlines it covers more than 220 destinations worldwide.

Fleet

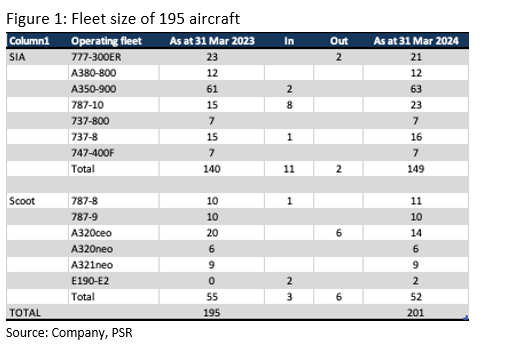

As at 31 March 2023, the group had 195 aircraft (Figure 1) in its operating fleet comprising 188 passenger aircraft and seven freighters. SIA’s operating fleet comprised 133 passenger aircraft and seven freighters, while its low-cost carrier arm, Scoot, had 55 passenger aircraft. It currently has 100 aircraft in its order book.

Capacity & Loads

SIA resumed flights earlier than other Asia Pacific carriers. Group passenger capacity reached 79% of pre-Covid levels in March 2023, higher than the 58% for the international scheduled services of Asia-Pacific airlines. Passenger load factor hit 85.4%, the highest in SIA’s history (Figure 2).

SIA plans to reach 83% of pre-pandemic capacity in 1H24, and we think it could achieve 100% in FY24e. However, passenger load factor could dip with more competition and tapering in demand. Cargo’s capacity will rise with more bellyhold space on passenger flights, but loads are expected to fall further with weaker exports and global manufacturing output (Figure 4).

Source: Phillip Capital Research - 22 Jun 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trader Hub

Created by traderhub8 | May 20, 2024

Created by traderhub8 | May 15, 2024

Created by traderhub8 | May 14, 2024